Best Accounts Payable Automation Software

Hard to believe there are businesses still using manual data entry in their accounts payable workflow. But a shift is taking place. Finance professionals are realizing that investing in accounts payable automation software and digitalization is how to stay relevant in the market. Like to see why, what, and how?

How to choose the right technology, map your AP processes, write an RFP, and onboard efficiently.

According to Ardent Partners’ 2024 State of ePayables report, organizations using AP automation software reduce invoice processing costs by 80%. Cutting processing times from weeks to days. With the average cost of processing a single invoice manually reaching $15-$40, automation is essential for financial sustainability.

“Accountants recognize the impact technology can have on the growth of their firms and are prioritizing tech investments to move their businesses forward. Nearly half expect to invest in and adopt automation tools (48%), artificial intelligence (48%), and blockchain technology (47%) over the next 12 months.”

Intuit QuickBooks Accountant Technology Survey

Manual data extraction

| $2.03 per invoice | 105 keystrokes per invoice | 111 seconds per invoice |

| 12.5% invoices needed rework | 3,840 invoices per month per FTE | 5.5 minutes to rework invoice |

Manual invoice processing is inefficient, expensive, and boring. So boring.

A day in the life of a CFO…

Invoicing, budgeting, coffee, record keeping, coffee, book entries, financial reporting, cash management, coffee, financial planning, compliance, loan negotiations, coffee…

So many numbers. So much room for error. My eyes are blurring just reading the list of tasks.

But, this person is responsible for managing all the financial activities of the business. Keeping it financially viable and operational. Keeping it alive.

Accounting automation frees up finance professionals’ time so they can focus on more strategic tasks. Digital technologies give them the power to improve and accelerate decision making, mitigate risks, and predict future financial outcomes.

According to Gartner’s 2024 Finance Technology Trends, 76% of CFOs cite process automation as their top priority for technology investment. With AP automation leading implementation plans.

To do this, they need the right tools. This post walks you through the AP process. What can be automated and the benefits of accounts payable automation software. I’ll finish up with some automated AP software you could splash some cash for…

Table of Contents

- A day in the life of a CFO...

- What's the accounts payable process?

- What is accounts payable automation?

- Why automate accounts payable?

- What are the benefits of accounts payable automation software?

- What AP tasks can I automate?

- What’s the ROI of accounts payable automation software?

- AP automation implementation checklist

- How does accounts payable automation software work?

- AI capabilities in advanced AP automation

- How to choose the top accounts payable automation software

- Best accounts payable automation software

- Accounts payable automation software FAQs

- Ready to up your accounts payable game?

What’s the accounts payable process?

Accounts payable, or procure-to-pay (P2P), manage every debt or liability owned by your business. The AP process workflow includes…

Invoice received

Unpaid invoices are received electronically – EDI, PDF, or receipt via a supplier portal – or in paper format. Basic optical character recognition (OCR) or AI document processing scans the paper invoices, to extract and store the captured data.

Review

The accounts payable team will then review the received invoices. Checking vendor identification, issue date, total, payment date. Invoices will also be matched against purchase orders, goods receipts, etc.

Approval

Once reviewed, the invoice passes for approval, quantity, and price verification.

Record & archive

The expense will then be manually entered in company books, and the invoice data archived.

Payment

The accounts payable department will send electronic payment or checks following authorization and recording of data.

What is accounts payable automation?

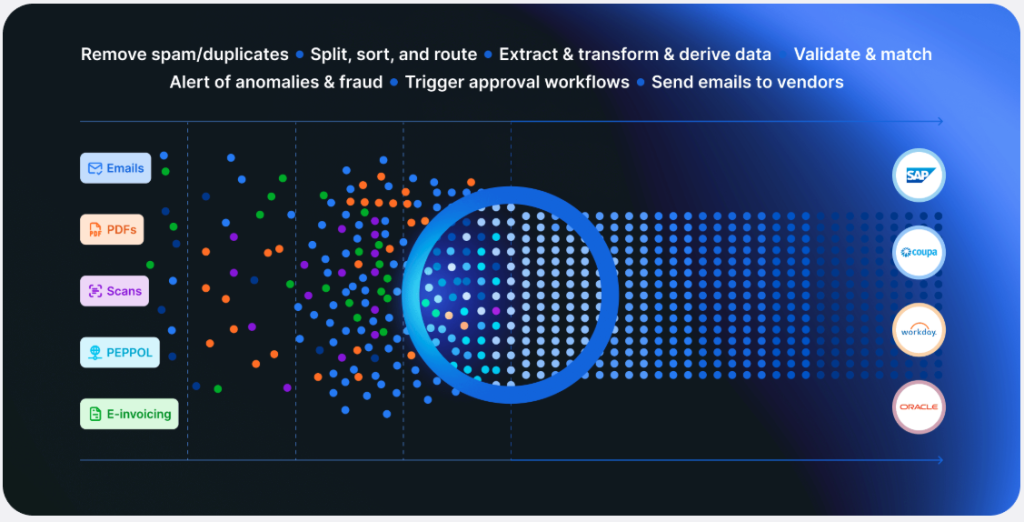

AP automation is a process that enables your accounts payable team to process invoices digitally rather than manually. Using AI document processing to perform the repetitive and tedious manual data entry tasks your AP team is currently struggling with. Automating the end-to-end process of accounts payable eliminate errors and save time.

Check out our P2P Automation Drives More Value From Every Transaction blog post for more details.

Why automate accounts payable?

Eliminating manual tasks reduces the cost of your AP document processing. Managing your payments and cash flow more efficiently, ensures the payment process is quick and increases the likelihood of benefiting from early payment discounts, while avoiding late payment penalties.

What are the benefits of accounts payable automation software?

The biggest benefit of automating the procurement process? Increased profits. Other advantages of AP automation include…

Time saved

Cutting out the manual stages of invoice processing will speed up your workflows end to end. Yes, there will still be humans in the loop, but the number of manual touches per invoice will be significantly reduced.

Money saved

Labor costs will be reduced, along with the cost of postage, paper usage, document storage, delivery costs, invoice production, etc. The reduction of errors improves the quality of the financial data. And, a faster process means late payments will be avoided, with early payment discounts caught.

Efficiency improved

Payment and invoice automation reduces approval times and increases productivity. Integrate with your financial tech stack and the information flow between systems will be unbroken. Enhanced efficiency improves relationships with vendors and partners.

When approvals that once took weeks happen in hours, your entire business operates more smoothly. Vendors receive payments faster, internal stakeholders get better visibility, and your finance team can focus on strategic initiatives rather than chasing paper.

Accuracy increased

With fewer humans in the loop, the level of errors is reduced. Payment errors – duplicate or fraudulent – will be reduced as invoice data will be validated automatically against ERP information. Bottlenecks will be eliminated and data inconsistencies identified early in the process.

Some accounts payable automation software solutions boast accuracy rates of 98-99%, virtually eliminating the costly errors that hamper manual systems.

Generative AI is Fueling a Surge in Invoice Fraud… discuss.

Brand trust boosted

Consumers expect full transparency and personalization, so when a business is upfront about its processes, trust increases. The best AP automation software also creates open communication across the board, with your team and vendors having full access to purchase orders, invoice status, and payments.

This transparency strengthens relationships throughout your supply chain and builds credibility with stakeholders who rely on efficient operations.

Audit compliance in the bag

Compliance rules are built in. This means suspicious activities and fraud can be flagged in real time.

Accounts payable automation tools also help businesses create visible audit trails. When auditors ask for information, you can provide full histories of every transaction with just a few clicks. Instead of digging through filing cabinets and email archives.

The reduction in compliance risk alone justifies the investment for many organizations.

Working with manual processes in your AP department makes it an easy target for invoice fraud. For more information on fake invoices, recognizing red flags, and avoiding being hit by an invoice scam, check out How To Identify Fake Invoices.

Security and regulatory compliance assured

Advanced AP automation solutions incorporate robust security features that help businesses meet key regulatory requirements including SOX, GDPR, and HIPAA. With role-based access controls, automatic logging, and encryption, your financial data stays protected while still being accessible to authorized personnel.

Sustainability benefits nailed down

By eliminating paper-based processes, accounts payable automation software reduces your organization’s carbon footprint. Going beyond the environmental impact, digital processes eliminate storage needs, reduce office space requirements, and cut utility costs associated with managing paper records.

What AP tasks can I automate?

While there are many tasks you can automate in accounts payable, cutting processing time and increasing accuracy are the biggies, as they’re going to lead to cost savings. Accounts payable automation software will improve payables-related tasks that include…

Data entry

Automating the data entry of your accounts payable documents speeds up the process and eliminates errors associated with manual data entry. What once took hours or days can happen in minutes.

Advanced systems can extract data from any invoice format with precision, regardless of how the supplier structures their documents. The software learns from each processed invoice, continuously improving its accuracy and requiring less human intervention over time.

Invoice matching

Three-way PO matching means you can match invoices and other related documents such as purchases orders and shipping receipts, quickly and accurately.

This automatic verification process flags discrepancies instantly, preventing overpayments and duplicate payments. The system can be configured to apply your business rules for acceptable variances, allowing straight-through processing for matched documents while routing exceptions to the appropriate personnel.

Coding invoices

Accounts payable automation software increases the efficiency and functionality of your invoice approval workflows. Set rules that automatically add the right general ledger code for each invoice.

The system learns from historical data to suggest accurate coding, even for new vendors or unusual purchases. This consistent application of accounting rules improves financial reporting accuracy and simplifies month-end closing processes.

Approval routing

Sending approvals automatically to all the necessary approvers in the invoice processing cycle enables more efficient tracking in the workflow. Complex approval hierarchies that once caused delays now function smoothly.

The system automatically identifies the correct approvers based on amount thresholds, departments, or expense categories.

Fraud detection

Accounts payable automation software uses AI to identify unusual patterns or suspicious activities that might indicate fraud attempts, protecting your business from financial loss.

The system can detect duplicate invoices, unusual amounts, unfamiliar vendors, or unexpected changes to payment details. With fraud attempts becoming increasingly sophisticated, these automated safeguards provide protection that manual systems cannot match.

Vendor management

Automated vendor onboarding, information updates, and performance tracking streamline relationships with suppliers and ensure data accuracy.

The system maintains a central repository of all vendor information, including tax forms, compliance certificates, and contact details. Automatic verification of banking information prevents payment errors, and performance metrics help you identify your reliable suppliers.

What’s the ROI of accounts payable automation software?

You’re in finance. You know that when deciding whether to spend money on a new bit of tech, the ROI is part of the yes/no decision.

When calculating the ROI of accounts payable automation software, it can impact different departments in your company, so there are a number of factors to consider. Financial and non-financial…

Financial ROI of accounts payable automation software

Numbers may vary, according to your industry, volume of invoices, and your current spend. But, the following are ROI proof points…

- Reduced cost of manual invoice processing

- Supplier questions about payment status reduced

- Losses due to human error minimized

- Increase in early payment discounts

- Reduced employee costs and churn

Non-financial ROI for accounts payable automation software

Non-financial ROI includes…

- Frictionless workflow processes

- Increased control

- Simple auditing and reporting from a unified platform

- Strengthened relationships – customers, vendors, suppliers

- Employee satisfaction – reduced churn

Beyond the direct financial benefits, accounts payable automation software transforms the work experience for your finance team. Tasks that once caused frustration become straightforward. Team members develop new skills managing the digital system instead of shuffling paper. The improved work environment leads to higher retention rates.

AP automation implementation checklist

Before implementing accounts payable automation software, ensure your business is ready by considering…

- Process assessment

Document your current accounts payable processes to identify inefficiencies and pain points. Map the complete workflow from invoice receipt to payment, identifying where delays typically occur and which steps require the most manual effort. - Technology readiness

Evaluate your current systems and integration capabilities. Determine which existing software the new solution has to connect with and whether your IT infrastructure can support the implementation. - Team preparation

Plan for training and change management. Identify champions in your team who can help drive adoption, and develop a communication strategy to address concerns about how roles might evolve. - Vendor evaluation

Create a shortlist based on your specific requirements. Consider not just features and costs, but also implementation support, industry experience, and customer satisfaction ratings. - Implementation timeline

Develop a realistic schedule for rollout that accounts for testing, training, and a measured transition. Consider starting with a pilot program on specific workflows before full deployment. - Success metrics

Define KPIs to measure implementation success beyond ROI. Include metrics for processing time, exception rates, early payment discount capture, and user satisfaction.

How does accounts payable automation software work?

Accounts payable automation software captures and digitizes paper invoices, then passes the invoice data through a virtual workflow, ending in payment to suppliers. Features include dashboards and analytics tools to help AP teams diagnose and fix issues, creating a frictionless accounts payable workflow.

OCR technology is used to extract the data from the invoices. The Rossum document processing platform uses machine learning to recognize patterns and learn like a human. Improving accuracy over time.

Creating your own business rules or regulations – approval hierarchies, acceptable variances, PO matching, and acceptable data variances – reduces the need for humans in the loop.

AI capabilities in advanced AP automation

Today’s advanced accounts payable automation software uses artificial intelligence in several key ways…

- Intelligent data extraction

AI can recognize and extract data from unstructured documents without templates. Handling multiple invoice formats with precision. The technology identifies relevant information regardless of where it appears on the page, eliminating the need for supplier-specific templates. - Pattern recognition

Systems learn from past invoices to improve accuracy over time, adapting to new formats and vendors automatically. The software develops an understanding of your specific business context, recognizing industry-specific terminology and your unique processing requirements. - Exception handling

AI can flag unusual items and suggest resolutions based on historical data and established patterns. When discrepancies occur, the system doesn’t just identify the problem – it recommends specific actions based on how similar situations were resolved in the past. - Predictive analytics

Forecast cash flow needs based on historical payment patterns, helping treasury management and budget planning. The system identifies seasonal trends and can help optimize payment timing to balance cash flow with vendor relationship management. - Continuous improvement

Systems become more accurate with use through machine learning, reducing the exception rate over time. Each processed document contributes to the system’s knowledge base, creating a positive feedback loop that enhances performance across all aspects of accounts payable.

How to choose the top accounts payable automation software

The best accounts payable software will help you create a seamless workflow automation, allowing you and your team to spend more time on business strategy tasks. When choosing the best AP automation software, you should consider…

Your goals

Determine your company’s goals for accounts payable automation.

- What requirements do you have for AP automation software?

- Which steps do you want to automate?

- Do you need multiple languages?

- Cloud or on premises solution?

When completed, write an RFP and deliver to vendors that meet your needs.

Vendors

Assess the proposals from each vendor. What features do they offer? How much does it cost? Is there onboarding, ongoing support? Ask for a free demo or a free trial?

Don’t just focus on the software capabilities – evaluate the company behind the product.

- How responsive is the team during the evaluation process?

- Do they take time to understand your specific challenges?

The vendor relationship will be crucial to your success. Choose a partner committed to your outcomes, not just selling you software.

Vendor evaluation criteria

Beyond features, consider these factors when selecting an accounts payable automation software vendor…

- Company stability

How long has it been in business? What’s its financial health? Investigate its customer retention rates and growth trajectory to ensure it’ll be a viable partner for years to come. - Customer support

What are its support hours? What languages are supported? Ask about typical response times and escalation procedures for critical issues. Request references from customers who have been using the system for over a year to understand the long-term support experience. - User community

Is there an active user community for knowledge sharing? A strong user community shows satisfied customers and a vendor that encourages collaboration and continuous improvement. - Innovation roadmap

How frequently does it release updates? What’s on its development roadmap? Ensure your chosen vendor stays ahead of industry trends and regularly enhances its solution. - Security certifications

Does it have SOC 2, ISO 27001, or other security certifications? Financial data requires strong protection. Verify that the vendor undergoes regular third-party security audits and maintains compliance with relevant standards. - Integration capabilities

How easily does the solution connect with your existing systems? The best software will fail if it can’t communicate effectively with your ERP, bank platforms, and other financial systems. Assess both current integrations and the vendor’s API architecture for future connections.

Any questions, check out How to Write an RFP, with a free RFP template included.

Best accounts payable automation software

Accounts payable automation software will streamline your AP process by automating repetitive tasks such as invoice data capture, data extraction, approval workflow, and payment processing.

Manual data entry errors will be eliminated and processing time reduced, leading to increased efficiency, cost savings, better financial management, and reduced employee churn struggling with tedious and mundane tasks.

There’s a wealth of great AP automation solutions out there, and I’ll add more over time. Check out my accounts payable automation software comparisons.

Ready?

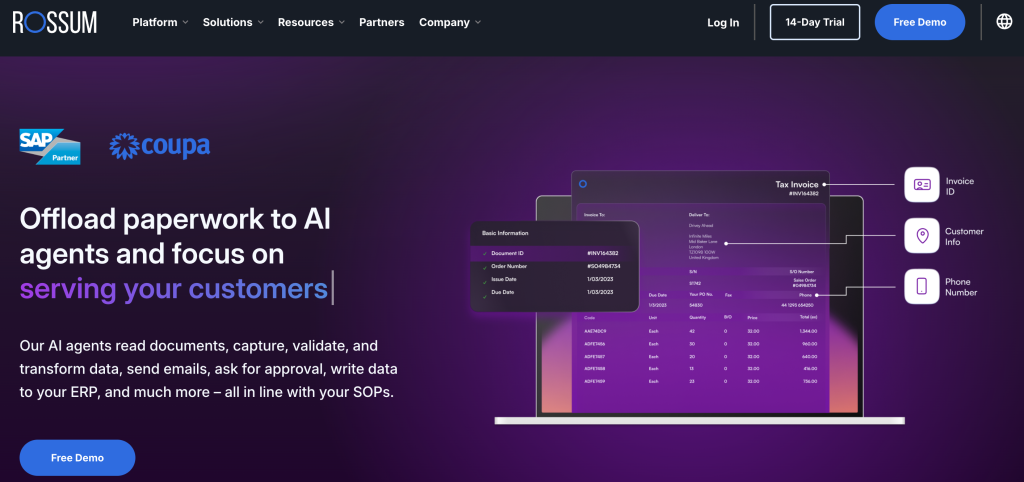

Rossum | AI document processing

AP automation software. Reads like a human. No rules. No templates.

As I said, there are a lot of AP automation tools to choose from. Selecting one for your business comes down to the specific needs of your organization – budget, size of team, volume of documents…

You’ll want an intuitive UI that’s easy to navigate and understand, so you can start automating your AP workflows as soon as possible.

Here’s Rossum…

Automate the full invoice journey from receipt to posting.

Our advanced AI engine – Rossum Aurora – is designed specifically for transactional document automation. Trained on millions of transactional documents, with outputs verified by annotators.

Unlike template-based systems that stumble down when faced with new document formats, our AI combines computer vision, natural language processing, and financial domain knowledge to read documents the way your AP experts do.

- Understands documents in 276 languages and handwriting in 30

- Improves with every document processed – adapting to your documents without training

- Automatically adapts to any invoice layout without new templates – removing IT from the picture

- Understands context to identify relevant data even when position varies

- Proprietary transactional large language model able to process structured and unstructured documents without hallucinations

Sage Intacct | ERP finance software

Cloud-based finance software.

“From scale-ups to global enterprises. Best-of-breed, cloud finance software.”

Improve your accounts payable performance and productivity when you integrate Rossum with Sage Intacct. A cloud-based ERP accounting system, endorsed by the AICPA (American Institute of Certified Public Accountants).

This comprehensive AP automation software has an intuitive user validation interface and customizable reports from its dashboard. Easy to navigate, and with a strong customer service team, you can improve operational efficiency, manage your IT costs, and find real-time insights.

Features include…

- Real-time customizable reporting

- Approval workflows control

- Electronic funds transfer

- Duplicate payment alert

- Reporting dashboards

- Time and expense management

- Project accounting

- Revenue management

BILL | Accounts payable automation software

Automating the future of finance.

“Create, send, and manage invoices, so you can get paid faster.”

Connect Rossum with BILL and you’ll increase the efficiency of your AP workflow. This cloud-native AP software uses cognitive data capture and fast validation to ensure quick and accurate invoice processing.

Targeted towards small and medium-sized businesses, BILL transforms how companies handle their finances by eliminating manual processes and paper. The platform processes over $140 billion in payment volume annually for more than 350,000 businesses, making them one of the most established players in the market. What distinguishes BILL is its focus on both sides of the transaction – it helps businesses not just pay bills but also get paid faster through streamlined AR processes.

Features include…

- Invoice processing

- Approval process control

- Cash management

- Duplicate invoice alert

- Electronic funds transfer

- Fraud detection

- Purchase order reconciliation

- Vendor management

Quickly generate invoices. Give customers an easy way to pay. Boost cash flow.

- Multiple ways to import your invoices into BILL

- Approval workflows tailored to your business rules

- Flexibility and control over the payment process

- Auto-sync between BILL and your accounting software

Stampli | AP automation & invoice management software

Automate AP without reworking your ERP.

“See how finance teams process invoices, approval workflows, and more with Stampli’s AP automation solution.”

Let me introduce you to Billy the Bot™ who automates almost all of your capture, coding, routing, fraud detection, and a whole of other tedious manual tasks.

Stampli gives you full visibility and control over your accounts payable process, reducing manual errors, fraud, and compliancy issues.

This software, developed specifically for AP teams promises automation without having to rework your ERP or change existing processes. What sets Stampli apart is its unique approach to collaboration – a platform built around the invoice rather than the accounting system. Creating a communication hub that centralizes all conversations about each transaction. This design reduces the email chains and phone calls typically associated with invoice questions and approvals.

Features include…

- Automated capture, coding, approvals

- Centralized collaboration

- Full accounting process module

- 2-/3-way PO matching

- Approval routing

- One-click access to all conversations

Meet Billy the Bot™

Payhawk | Accounts payable automation software & invoice management

“Control, manage and process company invoices at scale.”

Smarter accounts payable and invoice management software.

Payhawk helps AP teams optimize payment methods and handle invoices more efficiently. With the platform boasting a saving of more than two hours per day on manual finance processes.

Payhawk provides an integrated approach to spend management. Unlike AP-specific solutions, Payhawk combines expense management, corporate cards, and accounts payable in a single platform. This approach gives finance teams visibility into all company spending. For international businesses, its multi-entity support is able to handle different currencies, languages, and regional compliance requirements.

Features include…

- OCR data extraction in 60+ languages

- Intelligent machine learning that learns over time

- Supplier-driven expense categorization

- Manage supplier data in sync with your ERP

- Intelligent verification of supplier bank details

Coupa | Invoice management

Streamline accounts payable and improve cash flow.

“Rescue your AP department with efficient, accurate, and timely e-invoicing processing.”

A source-to-pay solution created to reduce manual processes and increase operational efficiency. You’ll be swapping paper invoices with e-invoices.

Automating the invoice process helps you benefit from early payment discounts and avoid late payment fines.

Coupa stands out with its Business Spend Management (BSM) approach that connects procurement, invoicing, and expense management in a comprehensive system that provides unmatched visibility into company spending.

Coupa’s community intelligence – anonymized insights from their vast customer base – helps you benchmark your performance against industry peers and identify optimization opportunities.

Make data-driven decisions, mitigate risks, and unite teams on company spending.

Create frictionless purchasing and accounts payable processes.

- Streamline intake and purchasing process and track in real time

- Create an AP process with automatic two- and three-way matching

- Work with suppliers at purchase order level with fast notification of issues

- Protect your cash flow with AI-driven fraud controls

- Create reports and share with stakeholders

Bonsai | Accounts payable automation software

“Win new clients, get paid faster, manage your finances.”

Comprehensive business management tool.

Bonsai is a great AP automation tool for start-ups and SMBs looking to automate their financial processes. From payments and invoicing, to banking and taxes.

You can integrate with your current accounting systems and CRM software to automatically process invoices, match invoices with purchase orders, and create purchase orders.

Particularly valuable for small businesses and freelancers is the all-in-one approach to financial management. The company offers proposal templates, time tracking, contract creation, and client portals. Everything needed to run a service-based business.

Its template library is extensive, saving hours of design work when creating professional documents. For businesses just starting their automation journey, Bonsai offers an accessible entry point with an easy learning curve.

Features include…

- Customize to your brand

- Automatically track expenses and income

- Send automatic payment reminders

- Built-in invoice templates

Accounts payable automation software FAQs

AP automation software identifies relevant approvers, automatically sending notifications and reminders. Streamline invoice processes. Reduce the number of humans in the loop. Late payments minimized, with penalties reduced.

AP automation creates an accurate, real-time record of comments and questions relating to a specific invoice or customer.

Validation checks built into AP automation software check all invoices and identifies duplicates, eliminating duplicate payments.

Controls can be added to your financial processes to prevent fraud and increase security. Approval limits can be applied to specific accounts and extra approval requirements can be implemented. In-built reporting tools increase visibility, so fraudulent or suspicious activity can be identified quickly.

Yes, they can be seamlessly integrated with existing ERP and financial systems, to enable real-time data flow.

Implementation timelines vary by organization size and complexity but typically range from 4-12 weeks. Cloud-based solutions generally deploy faster than on-premises options.

Yes, an advanced AP automation solution like Rossum supports multiple languages, currencies, and country-specific compliance requirements for global businesses.

Ready to up your accounts payable game?

Free eBook: Cost of doing nothing | Zero in on accounting automation

It’s time to take the leap. Cost of doing nothing | Zero in on accounting automation is our free eBook that explains what happens when you do nothing. When you persevere with manual document processing in accounts payable.

It highlights the benefits of accounting automation. Questions to ask an IDP vendor in your RFP. And, the impact of doing nothing.

Our goal is to help you devise an action plan for your business’ prospective AP automation strategy.