How to Automate Early Payment Discounts in Accounts Payable

Money left on the table. That’s what missed early payment discounts means. A 2% discount on $100,000 in monthly invoices equals $2,000 in savings. Scale that across your business, and you’re looking at hundreds of thousands in missed opportunities annually.

Download your free eBook. Your AP Automation Wake-Up Call.

Calculating the Cost of Doing Nothing [2025 Edition].

Manual accounts payable processes create this AP bottleneck. AP teams struggle to identify discount opportunities, track payment deadlines, and coordinate approvals fast enough to capture savings.

The result? Finance teams watch discounts expire while drowning in admin tasks.

I’m going to explore how AI document processing transforms early payment discount capture from a manual struggle into a strategic advantage.

Table of Contents

- What are early payment discounts in AP?

- Why businesses struggle with early payment discount capture

- The financial impact of missed early payment discounts

- How automation transforms early payment discount capture

- Implementation strategies for early payment discount automation

- Guidelines for maximizing early payment discount value

- Measuring success and ROI

- Technology implementation best practices for early payment discount automation

- Early payment discount automation FAQs

- Taking action on discount automation

What are early payment discounts in AP?

An early payment discount of 2/10 net 30 means the buyer pays 2% less if they pay within 10 days, instead of having to pay the full amount in 30 days.

These deals create mutual benefits…

- Suppliers improve cash flow through faster payments

- Buyers reduce procurement costs through discount savings

However, manual processing often prevents organizations from realizing these benefits.

The challenge gets worse with volume. Large enterprises process thousands of invoices monthly across multiple currencies, languages, and approval workflows. Tracking discount deadlines becomes impossible without structured automation.

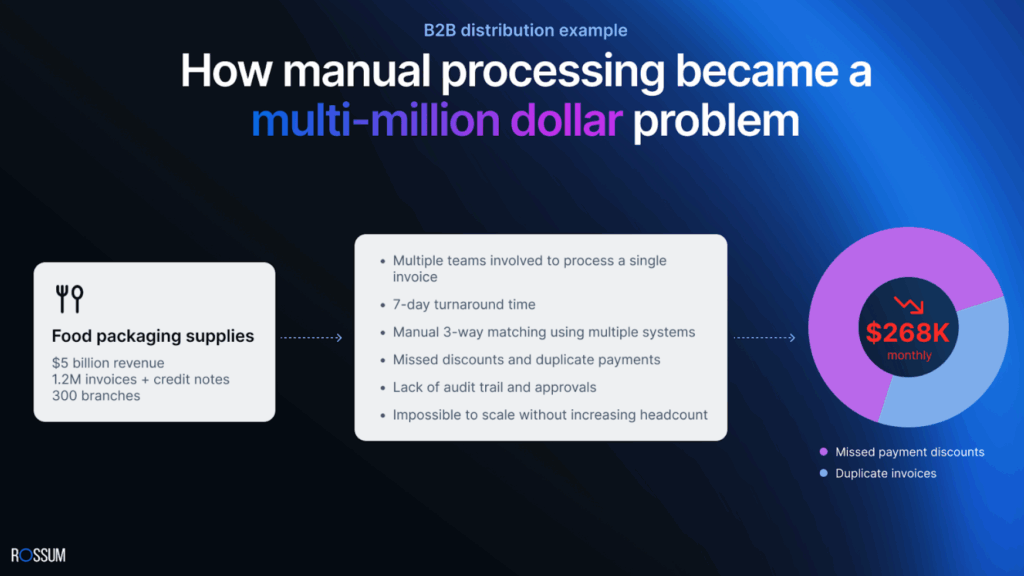

B2B distribution example – How manual processing became a multi-million dollar problem.

Early payment discounts differ from dynamic discounting programs…

- Traditional early payment discounts offer buyers a fixed discount for paying an invoice before the due date

- Dynamic discounting is a flexible approach where the discount rate is adjusted based on how early the invoice is paid

Why businesses struggle with early payment discount capture

Several key bottlenecks prevent effective discount capture…

Document processing delays

Finance teams review hundreds or thousands of invoices weekly to identify discount opportunities. They have to scan payment terms, calculate deadline dates, and flag time-sensitive discounts.

But discount terms appear in countless variations across suppliers. Some use standard “2/10 net 30” notation. Others write “2% discount if paid within 30 days”. European suppliers might say “Skonto 2% bei Zahlung innerhalb 10 Tagen”. Emails add another layer of complexity with phrases like “early bird discount available” or “pay be month-end for 1.5% savings”. Purchase orders, contracts, and invoice footers each present discount information differently.

Take a look at this example of discount term variations from Tomas, our CEO.

When invoices arrive in different formats, languages, or layouts, this identification process slows even more. Critical discount deadlines pass while documents await processing.

Approval workflow friction

Traditional approval chains prioritize compliance over speed, sacrificing savings for control. Invoices requiring multiple sign-offs rarely complete workflows within the discount timeframe.

Any delay – whether it’s due to holidays, competing priorities, or unavailable approvers – can push invoices past the discount window.

Payment processing limitations

Manual payment runs happen weekly or monthly at most organizations. Urgent payments demand special handling, which adds administrative overhead.

Wire transfers offer speed but increase costs. ACH payments provide economy but require longer processing windows. Organizations struggle to balance payment costs against discount savings.

Visibility and tracking gaps

Without centralized tracking, your finance team will lose sight of discount opportunities. Spreadsheets become outdated fast. Decision-makers lack real-time visibility into discount performance.

The lack of historical data prevents your team from measuring capture rates or identifying improvement opportunities.

The financial impact of missed early payment discounts

Imagine an enterprise processing $10 million in monthly invoices. If 30% of suppliers offer 2% early payment discounts, potential monthly savings equal $60,000. With annual savings reaching $720,000.

According to the Institute of Financial Operations and Leadership (IFOL), on average, AP teams capture just 58% of discounts. Teams with centralization and automation capture around 85% to 95%.

Beyond missed discounts, manual processing itself drives unnecessary costs.

Processing cost impact

Ardent Partners’ 2024 State of ePayables report states that organizations using AP automation software reduce invoice processing costs by 80%.

Manual invoice processing is resource-heavy. Industry data shows it takes an average of 111 seconds and 105 keystrokes to enter a single invoice, with 12.5% requiring rework. At 3,840 invoices per FTE per month, that adds up to hours lost on corrections and a processing cost of roughly $2.03 per invoice.

How automation transforms early payment discount capture

Intelligent automation addresses each manual processing bottleneck through systematic technology application.

Intelligent document processing

Machine learning models trained on millions of invoices automatically identify discount terms during invoice ingestion. The system extracts discount percentages, qualifying time periods, and net payment terms regardless of document format variations.

Advanced systems validate discount terms against supplier agreements and flag discrepancies for review, updating master data with new discount arrangements.

Accelerated approval workflows

Discount-eligible invoices trigger specialized approval workflows designed for speed. These workflows route invoices to appropriate approvers based on amount thresholds, department budgets, and company approval authority matrices.

The system provides full context including discount calculations, deadline dates, and net benefit analysis. Automated escalation prevents approval bottlenecks when primary approvers are unavailable.

Optimized payment processing

Payment engines analyze discount opportunities against cash flow positions and organizational priorities. They automatically determine optimal payment methods and timing for maximum financial benefit. Real-time tracking monitors payment status and provides alerts if delays threaten discount eligibility.

Performance analytics

Comprehensive reporting gives you visibility into discount performance across suppliers, departments, and time periods. Analytics identify optimization opportunities including supplier negotiations, workflow improvements, and cash flow planning enhancements.

Predictive analytics forecast discount opportunities based on spending patterns, supplier behavior, and seasonal variations. This forecasting enables proactive cash flow planning and resource allocation.

Implementation strategies for early payment discount automation

Successful automation requires strategic planning that addresses technology selection, process redesign, change management, and performance measurement.

Technology platform selection

Evaluate platforms based on three core criteria…

- Accuracy – leading solutions achieve high accuracy in discount term extraction across multiple languages and formats while understanding payment context, calculating discount amounts, determining deadlines, and prioritizing invoices by value and urgency

- Integration – seamless data flow with ERP systems, payment platforms, and treasury management tools

- Scalability – cloud-native solutions like Rossum that grow with business requirements and provide automatic updates of regulatory changes

Process redesign

Map current processes to identify automation opportunities and areas for manual intervention. Focus on eliminating handoffs, reducing approval layers, and accelerating cycle times.

Design exception handling procedures for complex discount arrangements, disputed invoices, and system errors.

Establish clear roles and responsibilities for discount program management and performance monitoring.

Phased implementation

Begin with high-volume suppliers offering consistent discount terms for immediate ROI and system confidence building.

Expand to complex discount arrangements, multiple currencies, and specialized approval requirements in phase two.

Phase three incorporates advanced features like dynamic discounting, supplier financing integration, and predictive analytics.

Once the foundation is in place, organizations can apply best practices to maximize value.

Guidelines for maximizing early payment discount value

Organizations achieving maximum discount value apply strategic approaches to supplier relationships, cash flow management, and program governance.

Supplier relationship optimization

- Negotiate discount terms during contract discussions rather than accepting standard offerings

- Use payment reliability and relationship value to secure better discount rates

- Provide suppliers with payment forecasts to improve their cash flow planning, often leading to enhanced discount offerings

Cash flow management integration

- Coordinate discount capture with cash flow forecasting to ensure adequate liquidity for accelerated payments

- Establish credit facilities for discount capture when cash flow timing creates constraints

- Monitor cash conversion cycles to balance discount savings against operational cash flow requirements

Program governance and optimization

- Establish clear policies governing discount capture priorities when cash flow limits prevent capturing all opportunities

- Create feedback loops between discount performance and supplier negotiations

- Regular reviews should analyze capture rates, missed opportunities, and ROI performance

Measuring success and ROI

Comprehensive measurement frameworks enable organizations to quantify automation benefits, identify optimization opportunities, and justify continued investment in discount programs.

Key performance indicators

Track discount capture rates as the primary success metric. Organizations typically improve discount capture rates by 30-35% through automation, capturing 75% more discounts than manual processes.

Calculate total savings including discount amounts and dodged late payment penalties. Monitor processing time reductions and exception rates.

ROI calculation factors

- Direct savings from increased discount capture rates

- Cost reductions from process automation

- Working capital optimization benefits

- Soft benefits including improved supplier relationships, enhanced cash flow visibility, and increased process standardization

Organizations typically realize positive ROI within 3-6 months, with top performers achieving 80% discount capture rates compared to less than 21% for most companies.

Technology implementation best practices for early payment discount automation

Platform selection and implementation decisions determine long-term program success. Organizations benefit from comprehensive evaluation frameworks that assess current needs and future scalability requirements.

Platform evaluation

- Request proof-of-concept testing with your actual invoice formats to validate accuracy claims

- Evaluate integration complexity with existing systems

- Consider disaster recovery needs since discount deadlines can’t accommodate extended outages

Integration

- ERP integration enables automated discount posting and maintains accurate financial records

- Payment platform integration ensures seamless processing and status tracking

- Treasury management integration provides cash flow visibility for complex requirements

Early payment discount automation FAQs

Most organizations realize positive ROI within 3-6 months. Full optimization may take 12-18 months as teams refine processes and expand automation scope.

Industry leaders achieve 80% capture rates for available early payment discounts, compared to less than 21% for most companies. However, 100% capture is rarely optimal due to cash flow constraints and strategic payment timing considerations.

Modern intelligent document processing platforms recognize tiered early payment discounts, volume-based arrangements, and conditional terms. Systems adapt to supplier-specific arrangements and handle multiple discount opportunities within single invoices. Unusual or complex arrangements may require initial configuration.

Automation improves supplier relationships by increasing payment reliability and reducing processing delays. Suppliers appreciate predictable payment timing and higher discount usage rates. Organizations should communicate automation benefits to suppliers and maintain relationship management alongside technological improvements.

Organizations need adequate cash reserves or credit facilities for accelerated payments without straining operations. Treasury teams should model working capital impact and ensure sufficient liquidity buffers. Balance discount savings against liquidity requirements and cost of capital considerations.

Comprehensive measurement includes total savings realized, processing cost reductions, cycle time improvements, and supplier satisfaction. Track missed opportunities to identify process gaps. Advanced analytics can measure working capital optimization, cash flow improvements, and strategic partnership benefits.

Taking action on discount automation

Early payment discount automation transforms manual struggles into strategic advantages. Organizations moving from capturing less than 21% to 80% of available discounts realize hundreds of thousands in annual savings while improving supplier relationships and operational efficiency.

The technology exists today to eliminate discount capture bottlenecks. Success demands strategic implementation addressing technology, process, and people considerations. Organizations benefit from phased approaches delivering quick wins while building comprehensive capabilities.

Every day of delay represents money left on the table. Finance leaders who act now not only protect margins but also position their organizations for stronger supplier partnerships and long-term efficiency.