What is AP Automation and How Does it Work?

Bean counters. Number crunchers. Revenue rockstars… Whatever you call them, your accounts payable people keep your business running. Makes you wonder why so many enterprises have AP teams bogged down in manual processes. Drowning under huge piles of paper. Why when businesses that adopt AP automation improve their competitive advantage? Processing invoices faster, capturing more early payment discounts, and reducing employee churn.

AP Automation Wake-Up Call

Calculating the Cost of Doing Nothing [2025 Edition]

I’m going to walk you through everything you need to know about AP automation. From basic concepts to implementation strategies that’ll deliver results.

Table of Contents

What is AP automation?

AP automation refers to the technology and processes that digitize and streamline accounts payable operations. Accounts payable automation eliminates manual tasks throughout the invoice processing lifecycle. From receipt to payment authorization.

Traditional AP departments face multiple inefficiencies…

- Manual data entry from paper invoices

- Physical routing of documents for approvals

- Error-prone matching of invoices to purchase orders

- Time-consuming exception handling

- Gruelling payment processing

- Physical storage and retrieval of financial records

AP automation transforms these tedious, repetitive processes through intelligent document processing. IDP technology that captures invoice data electronically. Routing data automatically based on predefined rules. Matching documents without human intervention, and integrating seamlessly with existing accounting systems.

The goal? Touchless invoice processing where human intervention is only needed for exceptions and strategic decisions.

How does AP automation work?

A comprehensive AP automation solution includes several related parts…

Invoice capture and data extraction

The process kicks off when an invoice lands with your AP team. Advanced AP automation platforms can receive invoices through multiple channels. For instance…

- Shared drives

- Supplier portals

- Electronic data interchange – EDI

- Scanned paper documents

Once received, data extraction tools automatically extract key information…

- Invoice number

- Date

- Vendor details

- Line items

- Tax information

- Payment terms

The best solutions use machine learning to improve accuracy over time, recognizing patterns in invoices from specific vendors.

Validation and matching

After extraction, an AP automation solution validates invoice data against predefined rules. The software automatically flags discrepancies like duplicate invoice numbers or calculation errors.

Three-way matching – comparing the invoice against purchase orders and receiving documents – happens automatically. AP automation checks that…

- Ordered quantities match received quantities

- Prices match agreed terms

- Payment terms align with vendor agreements

When this validation is done manually it’s a super slow process. With AP automation, we’re talking seconds.

Approval workflows

Documents that pass validation then move to invoice approval workflows. With invoices routed to the appropriate approvers based on…

- Department

- Amount levels

- Vendor relationships

- GL coding requirements

The approval workflows adapt to your organizational structure, with approvers receiving notifications to review, comment, and approve.

Integration with existing finance tech stack

AP automation integrates with…

- ERP systems

- Accounting software

- Payment platforms

- Vendor management systems

- Contract management solutions

This seamless integration means data flows smoothly between systems without manual intervention. Maintaining a single source of truth for financial information.

Payment processing

The last step is payment execution. Advanced AP automation platforms support various payment methods…

- ACH transfers

- Virtual cards

- International wire transfers

- Traditional checks – if they’re still a thing

Payment scheduling will optimize your cash flow and capture early payment discounts.

Analytics and reporting

AP automation solutions give you visibility into key metrics…

- Average processing time

- Cost per invoice

- Early payment discount capture rate

- Exceptions by type and vendor

- Payment status across your business

These insights will help you identify AP bottlenecks, improve vendor relationships, and make data-driven decisions.

What are the benefits of AP automation?

The advantages of AP automation go way beyond creating a paperless office. Here’s how this technology delivers tangible business value…

Cost savings

Manual invoice processing costs include labor, plus indirect costs such as storage. And don’t forget the hidden costs like fines applied because of errors identified in the audit process. This means the average cost to process an invoice is between $15 and $40.

If you’re processing 25,000 invoices a year, think of the money you could save by automating your processes. Savings made from…

- Eliminated manual data entry

- Reduced error correction time

- Lower document storage costs

- Minimized printing and postage expenses

- Reduced employee requirements for routine tasks

Fast processing cycles

Manual invoice processing typically takes 8 to 10 days. AP automation reduces this to hours. Minutes. This acceleration brings many benefits…

- Increased early payment discount capture

- Improved vendor relationships

- Better cash flow forecasting

- Reduced late payment penalties

- More strategic payment timing

Advanced accuracy and compliance

Human error. The plague of manual AP processes. Transposed numbers, misplaced decimal points, too many zeros, and duplicate payments will cost your business.

AP automation ensures consistent controls…

- Automatic duplicate detection

- Mathematical validation

- Tax calculation verification

- Payment authorization limits

- Audit trail documentation

These controls reduce errors while reinforcing compliance with internal policies and external regulations. Every transaction receives robust scrutiny, reducing fraud risk and simplifying audit readiness.

Two posts I’d recommend you read – How to Identify Fake Invoices and How to Identify a Duplicate Invoice. Both are going to save you a ton of stress and money.

Improved visibility and control

Manual AP processes can resemble a black box. Invoices disappear into approval workflows, surfacing weeks later for payment. Or getting lost entirely.

AP automation provides real-time visibility of…

- Current invoice status

- Bottlenecks in invoice approval processes

- Outstanding payment obligations

- Historical spending patterns by vendor, department, and category

Identifying spending patterns will help you make strategic decisions and create accurate cash flow forecasts.

Redeployment of talent

I’d say the most significant benefit is that AP automation frees finance professionals from transactional grunt work. Instead of manually typing in data and chasing paperwork, they can focus on…

- Vendor relationship management

- Payment term negotiation

- Spend analysis

- Process improvement

- Financial strategy

Transforming AP from a cost center into a strategic contributor to your business’ success.

AP automation implementation best practices

Implementing AP automation can trigger organizational shifts. The following best practices will help you maximize your chances of success.

Establish executive sponsorship

AP automation touches multiple departments in your business and will modify established workflows. Executive sponsorship – ideally from the CFO or CIO – is critical for…

- Securing must-have resources

- Aligning cross-functional teams

- Overcoming resistance to change

- Determine clear priorities

Map current processes to be automated

Understand your existing AP workflows before choosing automation technology, document…

- How invoices currently arrive

- Current approval routing paths

- Exception handling procedures

- Payment execution processes

- Integration points with other systems

Workflow process mapping reveals inefficiencies that automation might reinforce rather than eliminate.

Remember… automating a bad process just makes a bad process run faster.

Involve key stakeholders

AP automation will impact many of your stakeholders…

- AP specialists

- Approvers across departments

- IT teams

- Treasury professionals

- Internal audit staff

- Vendors

Including them in planning will ensure the AP automation solution meets their diverse needs and identifies potential challenges.

Determine clear success metrics

Establish concrete objectives before implementation…

- Target cost per invoice

- Processing time reduction goals

- Early payment discount capture rates

- Exception rate reduction

- User adoption metrics

These metrics will provide focus during implementation and ensure clear ROI analysis.

Consider a phased implementation

Rather than trying to automate everything in one hit, consider implementing AP automation in phases.

- Start with invoice capture and validation

- Add approval workflows

- Implement payment automation

- Integrate analytics and reporting

This approach will deliver incremental benefits. Controlling change and minimizing disruption.

Invest in change management

Technology implementation is only half the challenge. Successful AP automation needs human behavior to adapt…

- AP experts must adopt new tools

- Approvers need to respond through digital channels

- Vendors must submit invoices electronically

Comprehensive change management includes…

- Clear communication about reasons for change

- Thorough training for all teams

- Fast resolution of initial issues

- Celebration of early wins

- Ongoing support and learning during transition

Optimize vendor onboarding

The effectiveness of your automation plan will depend on supplier participation. Develop a strategy for comprehensive vendor enablement.

- Segment vendors by volume and importance

- Create comprehensive onboarding materials

- Provide multiple submission alternatives based on vendor capabilities

- Provide dedicated support during transition and afterwards

AP automation challenges and how to overcome them

Yes, AP automation benefits are obvious, but implementation can stumble. Here’s how to address common challenges…

Integration with legacy systems

Many enterprises use complex ERP systems developed years ago. These legacy systems may lack modern APIs for integration.

Solution

Choose AP automation vendors with extensive integration experience. When setting your budget, include integration work, as this can bump up costs if your existing systems are legacy.

Exception handling processes

The AP automation system that handles 100% of invoices without human intervention doesn’t exist. Exceptions need clear processes.

Solution

Build exception handling workflows as meticulously as standard processes. Route exceptions to specialists based on exception type. Track exception reasons to find opportunities for process improvement or vendor coaching.

Tackling change resistance

Let’s not beat about the bush. Some of your long-standing team members will resist automation, fearing job loss.

Solution

Implementation must be top-down, with clear communication of its purpose and benefits to gain employee support. Creating a culture of openness to AI, you can elevate skills development, job satisfaction, efficiency, productivity, and overall business performance.

“AI-powered invoice automation surpasses the limitations of template-based OCR by enabling adaptive learning and contextual understanding, allowing for greater accuracy and efficiency in data extraction, regardless of format or layout. To overcome resistance on the AP side, it’s essential to highlight how automation frees AP team members from repetitive tasks, empowering them to focus on value-added activities that support growth and improve the overall AP workflow.”

Ralf Dillmann – Partner, BearingPoint – Rossum’s Document Automation Trends 2025 report

To support our Document Automation Trends 2025 report, we surveyed 470+ finance leaders in the UK, US, and Germany. Across all industries. Our research and automation statistics reveal insights that’ll help you identify emerging opportunities. Transform your team’s productivity and position it as an innovation leader driving business growth.

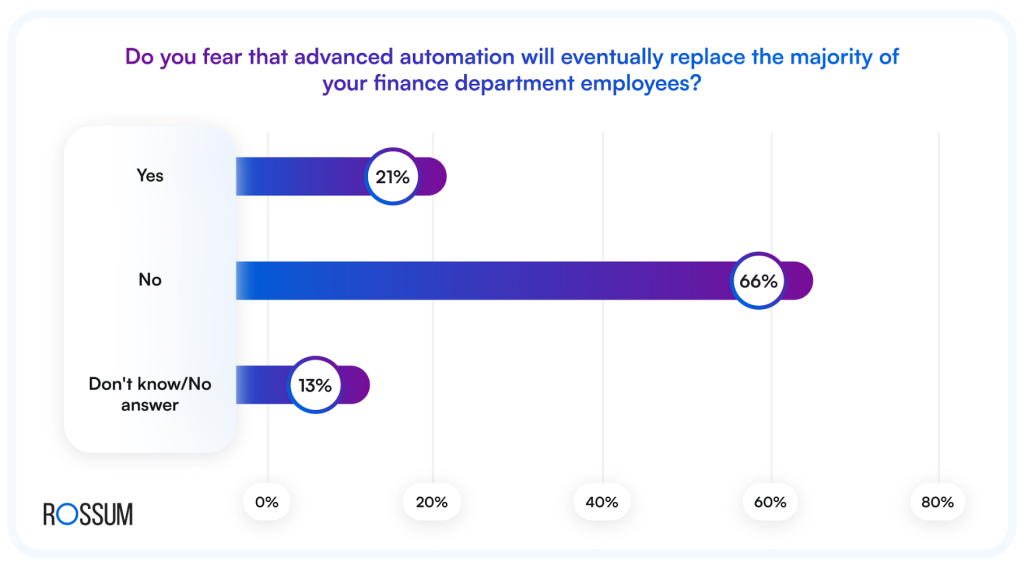

The majority of finance leaders are confident that automation will augment rather than replace.

Survey results show that 66% of finance leaders don’t fear losing their teams to advanced automation. Seeing it as a tool to augment rather than replace the workforce. Able to perform repetitive tasks, and allowing finance professionals to focus on strategic, high-impact work.

“There’s a narrative that sets AI against human workers in an all-or-nothing game. Headlines shout about job losses while vendors promise fully autonomous systems that eliminate the need for human intervention. But it misses – or ignores – the more nuanced and powerful reality. AI human collaboration. The ideal end state for businesses looking to maximize both efficiency and effectiveness.”

Why AI Human Collaboration is the Key to Automation’s Future

Maintaining proper controls

Automated invoice processing mustn’t come at the expense of financial controls.

Solution

Collaborate with internal auditors to build separation of duties to prevent fraud and errors, approval thresholds, and validation rules. Use automation to strengthen controls through consistent application of policies. Implement robust audit trails for all transactions.

How to choose AP automation software

Consider the following when evaluating AP automation software…

Deployment model

AP automation solutions come in three deployment models…

- Cloud-based SaaS platforms

- On-premises software

- Hybrid approaches

Cloud solutions like Rossum offer advantages in implementation speed, ongoing maintenance, and automatic updates. However, some companies with strict data residency requirements may prefer on-premises options.

Integration capabilities

Evaluate each solution’s ability to connect with…

- Your current ERP system

- Bank payment platforms

- Procurement systems

- Contract management tools

- Vendor portals

Ask for examples of successful integrations with systems matching yours. And API availability, integration maintenance, and handling of system updates.

Data capture accuracy

Data extraction underpins AP automation, so check solutions based on…

- Accuracy rates for line-item extraction

- Performance with your invoice formats

- Machine learning capabilities that improve over time

- Handling of non-standard documents

Sign up for a free trial so you can test your specific invoices to assess compatibility.

How Rossum Works walks you through setting up your trial account and how to put our platform to the test with your own documents. Dare you!

Approval workflow flexibility

Your company’s approval processes are unique. Make sure the AP automation solution you choose offers…

- Configurable routing rules

- Mobile approval capabilities

- Delegation options for approver absences

- Escalation paths for delayed approvals

- Comment and annotation features

Analytics and reporting

Comprehensive reporting separates advanced AP solutions from basic tools…

- Customizable dashboards

- Drill-down capabilities

- Export functionality

- Scheduled report distribution

- KPI alignment with your objectives

Vendor enablement services

Supplier adoption significantly impacts success. Check out…

- Vendor onboarding support

- Multiple invoice submission options

- Supplier portal functionality

- Communication tools for exception management

Security and compliance

Financial processes demand robust security measures are in place to protect sensitive data. Verify…

- SOC 1 and SOC 2 compliance

- End-to-end data encryption standards

- GDPR compliance features

- Role-based access controls

- Audit trail logging

- Multi-factor authentication

- Regular security audits

- Data backup and disaster recovery

Total cost of ownership

Look beyond subscription fees to understand…

- Implementation costs

- Integration expenses

- Per-transaction fees

- User license model

- Support and training costs

- Upgrade fees

Vendor partnership approach

AP automation represents a long-term relationship, so confirm the vendor’s…

- Implementation methodology

- Customer success resources

- Ongoing support model

- Product roadmap alignment with your needs

- Customer reference satisfaction

Ready to hunt for an intelligent document processing vendor? Check out How to Write an RFP for IDP so you don’t end up with a lemon.

AP automation with Rossum

Modern AP automation uses advanced AI technologies to transform invoice processing workflows. Systems like Rossum incorporate specialist AI agents to further enhance automation capabilities.

Cognitive data capture with AI agents

- AI-powered systems process invoices without requiring rigid templates or rules

- Document context is understood beyond simple text extraction

- Systems adapt to new invoice formats automatically through machine learning

- Specialist AI agents can be deployed for specific document types or processing steps

- Accuracy improves through continuous learning from processed documents

AI agents for enhanced automation

- Dedicated AI agents can make decisions for routine invoice scenarios

- Different agents can specialize in specific tasks like data extraction, validation, or exception handling

- AI agents learn from human validator decisions to improve over time

- Workload prioritization identifies which invoices need immediate attention

- Automated communication with vendors about discrepancies can be handled by specialized AI agents

- Pattern recognition in vendor behavior helps predict and prevent future invoice issues

AI human collaboration

When complex exceptions occur that AI agents cannot handle confidently…

- AP specialists can validate uncertain data points

- Human corrections teach the AI agents how to handle similar cases in the future

- The system maintains an effective balance between automation and human judgment

- AI agents serve as digital coworkers that handle routine tasks and escalate exceptions

ERP integration

Rossum offers integrations with major ERP systems including…

- SAP

- Microsoft Dynamics

- NetSuite

- Various custom financial systems

Look for pre-built integrations and adaptable AI agents that can work within your existing technology stack.

Analytics and continuous improvement

Comprehensive AP automation with AI agents provides visibility into operations through…

- Processing volume trends by agent type

- Accuracy metrics for different AI agents and document types

- Learning curve analysis showing agent improvement over time

- Exception patterns and resolution pathways

- Process bottleneck identification

With these insights you’ll be able to optimize the human and AI components of your AP process. Demonstrating ongoing ROI improvements as the system learns.

Give your AP team a break

AP automation is a strategic transformation of a core business function. The technology continues to improve, the benefits and competitive advantage are proven.

Automating your accounts payable processes will reduce processing costs and improve cash management.

The enterprises that win aren’t going to be those that process transactions efficiently. The winners are those that use technology to elevate their financial operations into strategic advantages.

Your AP automation journey starts today. Give your AP team, vendors, and bottom line a break.

AP automation FAQs

Implementation timelines vary based on complexity and scope. Simple implementations that focus on invoice capture can take 4-6 weeks. A comprehensive solution that includes, for instance, approval workflows and ERP integration typically takes 3-6 months. Factors affecting the implementation timeline include the number of approvers, complexity of approval rules, ERP system integrations, and vendor onboarding requirements.

AP automation introduces cybersecurity considerations including data breach risks, payment fraud, and unauthorized system access. Minimize these risks by implementing multi-factor authentication, role-based access controls, data encryption, regular security audits, and comprehensive user training. Choose vendors like Rossum with SOC 2 compliance and documented security protocols.

Automated AP solutions support localization management that includes multi-currency processing, automatic exchange rate application, and country-specific tax compliance including VAT, GST, and sales tax requirements. They can extract tax-related information from invoices and validate calculations according to jurisdiction-specific rules. For global enterprises, look for solutions with built-in compliance capabilities for your operating regions.

Most solutions offer configurable approval hierarchies, conditional routing based on invoice attributes (amount, vendor, department, etc.), delegation control, and escalation paths. Custom validation rules can be created for specific vendor requirements. The level of customization does vary by platform, with enterprise solutions offering more flexibility.

AP automation improves vendor relationships with faster payments, invoice status transparency, reduced payment errors, and consistent communication. Build a thorough vendor onboarding strategy with clear communication about format requirements and submission processes to ensure smooth adoption.

No. Your team will be able to stop tedious tasks like data entry and manual matching. Shifting to exception handling, vendor relationship management, and financial analysis. Rossum’s specialist AI agents are digital coworkers, or virtual junior colleagues. They’ll escalate to humans when lacking confidence or hitting guardrails. Humans calling the shots. This mutual learning relationship enhances human and AI capabilities over time.

Traditional OCR technology converts text images to machine-readable characters, requiring templates and rules to interpret data. Intelligent document processing combines OCR with AI technologies like machine learning and natural language processing. To understand document context, adapt to variations, and improve accuracy over time. This advanced approach reduces configuration effort and handles document variability more effectively.

Track the reduction in cost per invoice processed. Shortened processing cycle time. Early payment discount capture rate. Exception rate reduction. Percentage of touchless invoice processing, And team time reallocation to strategic activities. Make sure you establish baseline measurements before implementation to accurately track improvements.