Unlock AP Efficiency with Touchless Invoice Processing Automation

Accounts payable teams face increasing pressure to process invoices quickly and accurately. Traditional manual invoice processing methods eat up valuable time. They’re also prone to errors that can lead to payment delays, duplicate payments, and strained supplier relationships. Touchless invoice processing is a transformative solution that automates the invoice lifecycle end to end, minimizing human intervention and maximizing efficiency.

Touchless invoice processing automates the entire invoice lifecycle, from capture to payment, with minimal or no human intervention.

Download How Plan Your Next AP Automation Project eBook.

Table of Contents

- What is touchless invoice processing?

- Manual invoice workflow vs touchless invoice processing

- How touchless invoice processing works

- Benefits of touchless invoice processing

- Customer case studies

- How to implement touchless invoice processing

- How to overcome implementation challenges

- Hands up for touchless invoice processing

- Touchless invoice processing FAQs

What is touchless invoice processing?

Touchless invoice processing refers to the full automation of the invoice management lifecycle with minimal to zero human intervention. Using optical character recognition (OCR), artificial intelligence, and machine learning, touchless invoice processing captures, validates, and processes invoices seamlessly through predefined workflows.

The goal is to remove manual touchpoints throughout the accounts payable process, reducing processing time and eliminating human errors.

Manual invoice workflow vs touchless invoice processing

A manual invoice process involves your AP team handling tasks like receiving supplier invoices, matching, and data entry. Only then can payment be made. A process that’s slow, prone to errors, with the possibility of duplicates.

There are a lot of manual touchpoints. For example, when data is extracted and reviewed, your AP staff must record and validate information such as vendor name and quantity of goods from each individual invoice. This makes the process not only mind numbing, but prone to errors. An invoice may not be checked correctly, or data from the same invoice may be entered twice by two different team members.

So many touchpoints where errors can occur…

- AP teams manually receive vendor invoices through multiple channels – mail, email, scanners, shared drives…

- Teams have to extract and input data from each invoice into their accounting system

- Invoice validation requires manual cross-checking against purchase orders and receiving documents

- Physical or digital routing for approvals creates bottlenecks and delays

- Payment scheduling requires additional manual steps

A hands-off approach

Touchless invoice processing streamlines operations with automation…

- Invoices are digitally captured regardless of format – PDF, EDI, e-invoice, paper

- AI document processing platform automatically extracts relevant data accurately

- Intelligent validation checks data against purchase orders, receipts, and vendor details

- Exceptions are flagged for review while standard invoices follow automatic invoice approval workflows

- Payments are scheduled according to predetermined terms and policies

How touchless invoice processing works

Implementing touchless invoice processing involves several key steps…

Invoice capture

The process kicks off with the digital capture of invoices, often received in various formats. Whether they arrive as PDFs via email, EDI transmissions, or even paper invoices, modern OCR technology digitizes and standardizes them. Advanced AI OCR software can achieve accuracy rates up to 99%. However, accuracy may vary depending on invoice quality and structure.

Data extraction and validation

AI algorithms extract critical information from invoices, including…

- Vendor details and tax identification

- Invoice numbers and dates

- Line item details and quantities

- Payment terms and due dates

- Tax calculations and totals

The data is then validated by matching it with purchase orders, receiving documents, and vendor master data. This automated validation ensures accuracy and compliance, flagging discrepancies for human review.

Automated approval workflows

Validated invoices are automatically routed through predefined approval workflows based on business rules. For example…

- Invoices matching POs within confidence levels can be approved automatically

- Invoices exceeding certain amounts may need additional approvals

- Different teams or cost centers may have their own approval chains

These workflows can be configured to align with organizational chains of command and compliance requirements. Stakeholders receive alerts when action is needed, and the system maintains a full audit trail of all approval activities.

Payment processing and integration

Once approved, a touchless invoice processing solution schedules payments according to predetermined terms or payment strategies. Integration with enterprise resource planning (ERP) systems ensures that all financial records are updated in real time, helping to maintain data integrity and compliance.

Analytics and reporting

Advanced invoice processing automation provides comprehensive analytics and reporting capabilities, giving insights into…

- Processing times and bottlenecks

- Cash flow projections

- Supplier performance metrics

- Early payment discount opportunities

- Compliance and audit readiness

Read Why Finance Leaders Must Drive AI Implementation Now for more information.

Benefits of touchless invoice processing

The transition to touchless invoice processing brings numerous benefits that impact operational efficiency and financial performance…

Increased efficiency

A high level of AP automation reduces the time required to process invoices. Enabling faster payments and improved cash flow management.

- Reduced invoice cycle times from weeks to days

- Increased invoice processing volume without hiring new employees

- Elimination of backlog and late payment issues

Cost reduction

The financial impact of touchless invoice processing goes way beyond the obvious savings in labor costs…

- Reduced processing costs per invoice

- Elimination of late payment penalties

- Capture of early payment discounts

- Reduced audit preparation time and costs

- Prevention of duplicate payments and fraud

Read How to Identify Fake Invoices and How to Identify a Duplicate Invoice for more information.

Improved accuracy and compliance

Touchless invoice processing improves data quality and compliance…

- Reduction in data entry errors

- Consistent use of approval policies

- Full audit trails for regulatory compliance

- Prevention of unauthorized or fraudulent payments

- Standardized tax treatment and documentation

Strengthened supplier relationships

The downstream effects of touchless processing extend to supplier relationships…

- Timely and accurate payments build supplier trust

- Transparency in invoice status improves communication

- Reduced supplier inquiries free up your AP team

- Better cash flow visibility enables strategic payment timing

Strategic business impact

Touchless invoice processing transforms accounts payable from a cost center to a strategic function…

- Team redeployed to value-added analysis and strategic initiatives

- Data-driven insights for procurement optimization

- Enhanced cash flow forecasting

- Improved decision making through real-time financial visibility

Customer case studies

Enterprises across various industries have achieved awesome results by implementing touchless invoice processing.

Fugro’s success automating invoice processing globally

Fugro, a global leader in geotechnical survey and geoscience services, faced a challenge in managing nearly 300,000 invoices a year across multiple suppliers and countries.

Its previous invoice tool couldn’t learn or adapt, creating inefficiencies. Looking for a scalable solution, Fugro partnered with Rossum to implement AI-powered automation across four global locations in three months.

The self-learning AI and customizable copilot feature enabled invoice translations, formula adjustments, and full visibility of the invoice lifecycle. As a result, processing time dropped from 2 minutes to 35 seconds per invoice. Integrating seamlessly with its ERP system, the company reduced errors, enhanced efficiency, and empowered teams to focus on strategic tasks.

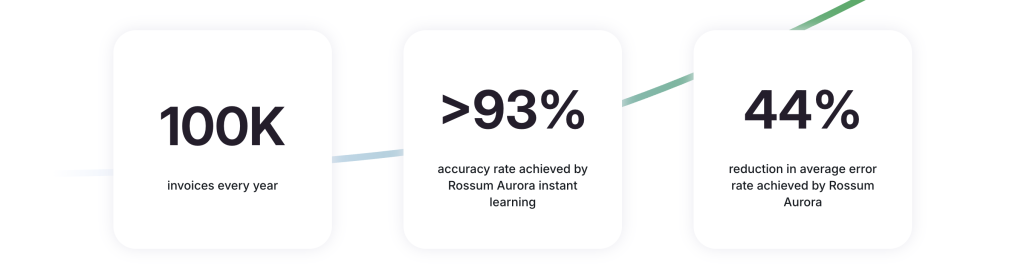

How Wolt accelerated AP AI automation and reduced error rates by 44%

>93% accuracy rate achieved by Rossum Aurora instant learning.

Wolt is a Helsinki-based technology company founded in 2014 and acquired by DoorDash in 2022.

Challenge?

“We wanted to automate the AP process and needed a solution that was flexible enough to process over a hundred thousand invoices per year in a wide variety of structures. We felt that Rossum was able to do that.” Vishal Karkala, Product Lead Supply Chain & Inventory.

Solution…

Rossum was seamlessly integrated with Wolt’s proprietary ERP system. The AP department wanted to specify the data fields they needed to extract, regardless of document structure. Rules were customized so if a data field is missing, the system alerts the user to add that data before further processing is allowed. As a result, the data that arrives in the ERP system is accurate and in the expected format.

Automation rates increased by 12.5% within 2 days. With 58.8% of invoices processed touchlessly, freeing up the AP team from low-value manual tasks to focus on more complex and strategic work.

How to implement touchless invoice processing

Transitioning to touchless invoice processing requires comprehensive planning and execution…

Assessment and planning

Start with a comprehensive evaluation of your current AP processes…

- Map your existing workflows and identify pain points and automation potential

- Calculate current processing costs and cycle times

- Define clear objectives and success metrics

- Collect feedback from stakeholders – finance, IT, and operations

- Develop a step-by-step implementation strategy

Choosing the best technology

Choose a touchless invoice processing solution that aligns with your business needs…

- Confirm integration compatibility with your existing ERP and accounting systems

- Verify AI and machine learning capabilities for data extraction

- Evaluate configurability of invoice approval workflows

- Assess security features and compliance certifications

- Review scalability for future growth – paperwork will increase

Change management and training

Don’t ignore the human aspect of implementing new technology…

- Communicate benefits to all stakeholders

- Provide comprehensive training for your AP team

- Establish clear metrics to track adoption and performance

- Celebrate early wins to build momentum

According to Deloitte, “high-performing organizations are 3.5 times more likely to use data to inform change efforts and 4 times more likely to gain worker input when shaping changes.”

Read Why AI Human Collaboration is the Key to Automation’s Future.

Supplier onboarding

Engage with your supplier’s network to maximize automation…

- Educate suppliers on the advantages of electronic invoicing

- Provide multiple options for submission methods – portal, EDI, email, etc.

- Create communication channels for questions and support

- Consider a phased approach onboarding high-volume suppliers first

Continuous optimization

Monitoring and optimizing must be ongoing to identify pain points and areas for improvement…

- Monitor KPIs such as touchless rate and cycle time

- Gather feedback from users and suppliers

- Regularly refine business rules and workflows

- Expand automation to additional invoice types and exceptions – non-PO invoices, services, etc.

How to overcome implementation challenges

While the benefits are huge, you may hit some obstacles during implementation…

Integration complexity

Challenge – Ensuring seamless integration with existing ERP and accounting systems.

Solution…

- Perform a thorough systems analysis before implementation – involve IT

- Choose solutions with proven integration capabilities for your ERP

- Implement in phases to minimize disruption

Data quality

Challenge – Poor quality invoice data can delay automation.

Solution…

- Clean and standardize vendor master data before implementation

- Establish data governance processes for ongoing maintenance

- Work with AI solutions that learn and improve with experience

- Collect feedback to continuously enhance data quality

Resistance to change

Challenge – Employees may resist/fear changes to established processes.

Solution…

- Include your AP team in solution evaluation and configuration

- Demonstrate how automation eliminates tedious tasks, not jobs

- Provide new career paths focused on analytical skills

- Highlight early wins and success stories from similar companies

Supplier adoption

Challenge – Supplier reluctance to change invoicing methods.

Solution…

- Communicate clear benefits to suppliers – faster payments, visibility, etc.

- Encourage suppliers to adopt e-invoicing

- Offer multiple submission options to meet different capabilities

- Provide easy onboarding processes and support resources

Hands up for touchless invoice processing

As technology continues to advance, touchless invoice processing will become the gold standard for accounts payable teams. The integration of AI and machine learning will improve automation capabilities, leading to predictive analytics and intelligent decision making.

Touchless invoice processing will enable finance teams to transition from transaction clerks to strategic business partners. Eliminating manual data entry, reducing errors, and accelerating processing times means your AP team can focus on value-added activities like spend analysis, supplier relationship management, and working capital optimization.

For companies considering the transition, the key is to start with a clear vision as to what you want to achieve. Choose the right technology partner, and implement both processes and your people top of mind. With solutions like those offered by, for instance, Rossum, enterprises can successfully implement touchless invoice processing for improved efficiency, accuracy, and competitive advantage.

Touchless invoice processing FAQs

Touchless systems process multiple invoice formats including structured (PDFs, EDI, XML, e-invoices), semi-structured (paper via OCR), and complex multi-page documents. Advanced AI algorithms handle invoices with varying tax structures, multiple currencies, and industry-specific formats. Learning and improving accuracy with each processed document.

Touchless invoice processing reduces errors through automated 3-way matching, tax validation, duplicate detection via company-specific business rules. Systems typically reduce error rates by 80-95%, while learning from exceptions to prevent future issues. Real-time validation ensures compliance with global regulations including VAT/GST requirements and industry mandates.

Yes, a modern solution such as Rossum offers certified connectors for major ERP platforms (SAP, Microsoft Dynamics, NetSuite, and more). These integrations extend to procurement systems, vendor databases, and payment platforms.

Touchless invoice processing combines advanced computer vision and OCR, natural language processing for contextual understanding, machine learning algorithms that adjust to your invoice patterns, RPA for repetitive tasks, and predictive analytics to identify potential issues.

The system tries self-correction using historical patterns and contextual data. If automatic resolution isn’t possible, it classifies the exception type and routes it to the appropriate human expert with a detailed report and recommended actions.

Touchless processing improves supplier relationships through punctual payments, automated status updates that reduce inquiry calls, self-service portals for invoice submission and tracking, dynamic early payment opportunities, and faster dispute resolution with full audit trails.