How to Choose the Right IDP Partner for Finance Automation and AI Success

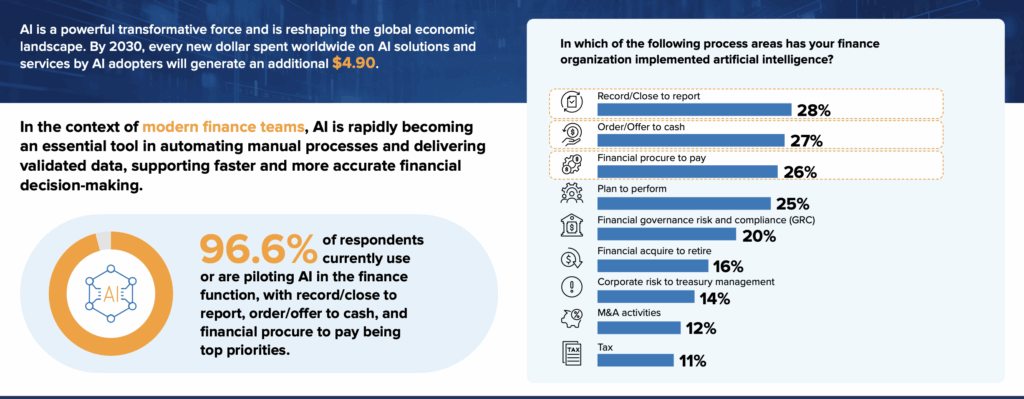

Finance leaders face mounting pressure to modernize operations while maintaining accuracy and compliance. With 96.6% of organizations already using or piloting AI in finance functions, the question isn’t whether to automate – it’s how to choose the right intelligent document processing (IDP) partner to ensure your investment delivers measurable results.

From Bottleneck to Powerhouse: Unlocking Strategic Value in Accounts Payable Through AI. A data-driven research document offering insights on technology, market trends, and business strategies – sponsored by CrossCountry Consulting and Rossum.

The stakes are high. According to IDC research, 61% of CFOs cite “too many unknowns and lack of control” as the biggest barrier to AI implementation. Meanwhile, manual accounts payable processes continue to drain resources, with 25% of organizations reporting that more than 10% of transactions require correction.

This guide examines the critical factors for selecting an IDP partner that aligns with your strategic objectives, minimizes implementation risk, and positions your finance function for long-term success.

Why partner selection determines project success

Selecting the wrong IDP provider creates cascading risks that extend far beyond initial implementation costs. Poor partner selection can result in:

- Technology obsolescence within months of deployment, leaving your organization with outdated tools that can’t adapt to changing business requirements or document formats.

- Failed implementations that waste significant resources. Organizations often underestimate the complexity of data migration, vendor master data cleaning, and historical transaction integration.

- Ongoing operational disruptions when systems can’t handle real-world document variability or integrate seamlessly with existing ERP platforms.

The right intelligent document processing partner balances cutting-edge technology with strategic insight, ensuring solutions remain scalable and future-proof. They understand that successful automation requires more than software deployment – it demands comprehensive change management, training, and ongoing support structures.

Essential qualities of a strategic IDP partner

Deep technology expertise

Your IDP partner must demonstrate comprehensive understanding of AI, machine learning, and finance-specific automation requirements. Look for providers who offer:

- Template-free processing that adapts to various document formats without manual configuration.

- Multi-language capabilities for global operations.

- Advanced exception handling that maintains accuracy while minimizing manual intervention.

Transparent AI architecture that avoids black-box algorithms, ensuring auditability and compliance.

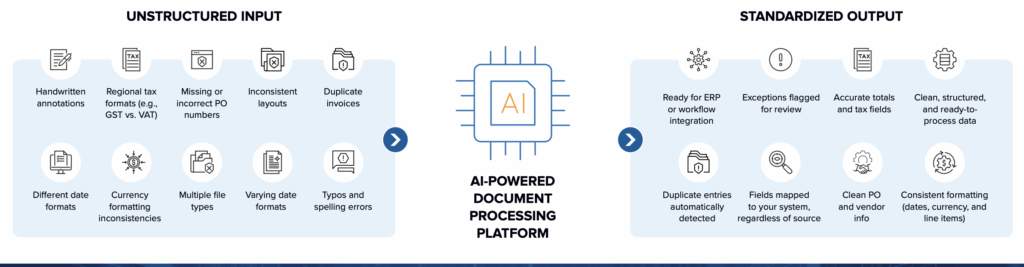

AI-powered document processing software can standardize and structure documents,

so AP teams can work with clean, reliable data.

Strategic advisory capabilities

Exceptional IDP partners function as trusted advisors, not just technology vendors. They should:

- Map your current finance capabilities to enterprise-wide strategic goals.

- Provide insights on process optimization before automation implementation.

- Offer guidance on KPI evolution and success measurement.

- Present clear roadmaps for scaling automation across additional use cases.

Proven implementation track record

Evaluate potential partners based on documented success metrics from similar implementations:

- Time-to-value achievements showing accelerated deployment timelines.

- Accuracy improvements with specific before-and-after processing rates.

- Cost reduction data demonstrating ROI across different organization sizes.

- Client retention rates indicating long-term satisfaction and partnership success.

Commitment to long-term partnership

The best IDP partners ensure their solutions evolve alongside your business. Essential elements include:

- Comprehensive training programs for finance and IT teams.

- Scalable architecture that accommodates growth and changing requirements.

- Robust change management support during implementation and beyond.

- Ongoing optimization services that enhance performance over time.

Evaluating potential IDP partners: A strategic framework

Step 1: Conduct internal needs assessment

Before engaging potential partners, audit your existing workflows to identify:

- Manual bottlenecks in accounts payable, procurement, and financial reporting processes.

- Document volume and variety including invoices, purchase orders, receipts, and contracts.

- Integration requirements with current ERP systems and financial software.

- Compliance obligations specific to your industry and geographic locations.

This assessment provides the foundation for meaningful partner discussions and accurate solution scoping.

Step 2: Develop clear selection criteria

Establish transparent evaluation standards focusing on:

- Technology compatibility with existing systems and future growth plans.

- Security and compliance capabilities meeting your industry requirements.

- Implementation methodology including timeline, resource requirements, and risk mitigation.

- Pricing transparency with clear understanding of ongoing costs and scaling implications.

Step 3: Conduct proof of concept testing

Smart organizations test potential partners through limited-scope implementations. For accounts payable automation, this might include:

- Processing sample invoice batches to evaluate accuracy and exception handling.

- Testing payment workflow integration without disrupting existing cash flow processes.

- Evaluating system performance during peak processing periods.

- Assessing user experience for both technical and business users.

Request detailed documentation of testing results, including specific accuracy rates, processing times, and exception frequencies.

Step 4: Prioritize change management expertise

Successful IDP implementation requires more than technical deployment. Evaluate partners on their ability to:

- Design comprehensive training programs tailored to different user groups.

- Facilitate organizational alignment across finance, IT, and operations teams.

- Provide ongoing support structures that ensure sustained adoption and optimization.

- Manage stakeholder expectations throughout the implementation process.

How strategic partners drive measurable value

Leading IDP partners deliver value through a comprehensive approach that addresses both immediate automation needs and long-term strategic objectives.

- Streamlined financial workflows: Advanced IDP solutions can reduce invoice processing times by 75% while improving accuracy rates above 95%. This allows finance teams to focus on strategic analysis rather than manual data entry and error correction.

- Enhanced forecasting capabilities: By standardizing and structuring incoming document data, IDP platforms enable more accurate cash flow forecasting and working capital optimization – critical metrics for CFO success.

- Proactive issue resolution: Experienced partners anticipate common implementation challenges including data migration complexities, stakeholder resistance, and integration difficulties. They provide proven frameworks for overcoming these obstacles before they impact project timelines or budgets.

- Scalable success models: The best partnerships begin with focused use cases like accounts payable automation but include clear pathways for expanding to additional document types and business processes.

Red flags to avoid

Certain partner characteristics signal potential implementation challenges:

- Unrealistic promises of 100% automation or accuracy rates without acknowledging real-world document variability.

- Lack of transparency about AI methodology or inability to explain processing decisions.

- Limited integration experience with your specific ERP platform or financial systems.

- Inadequate ongoing support structures or unclear post-implementation service models.

- Inflexible pricing that doesn’t accommodate business growth or seasonal volume changes.

Building long-term partnership success

The most successful IDP implementations result from true partnerships rather than vendor relationships. Engage your chosen partner early in strategic discussions about:

- Future automation roadmaps beyond initial use cases.

- Integration opportunities with emerging financial technologies.

- Performance optimization strategies that evolve with your business.

- Change management approaches that ensure sustained user adoption.

Transform your finance function with confidence

Choosing the right IDP partner represents a strategic decision that impacts your organization’s operational efficiency, financial accuracy, and competitive positioning. By focusing on partners who combine deep technical expertise with strategic advisory capabilities, you can ensure your automation investment delivers sustainable value.

To capitalize on full-lifecycle implementation support solutions, IDP providers collaborate closely with leading implementation advisors, such as CrossCountry Consulting. Ready to explore how AI and automation can transform your finance operations?

This is a guest post from CrossCountry Consulting.