Why Finance Leaders Must Drive AI Implementation Now

Financial leadership is undergoing a seismic shift. Leaders who strategically roll out AI implementation will navigate their organizations to further success. Those who hesitate risk becoming irrelevant. This is the scary reality facing CFOs. Evidence? Gartner predicts that by 2025, over 40% of finance roles will be transformed by technology. Yet many finance leaders remain paralyzed by indecision. I believe we’re at the point of no return. A reshaping of the finance process demands immediate attention.

A new year, a new Document Automation Trends report for 2026.

From hype to hard returns. The finance playbook for automation at scale. Includes automation stats, expert analysis, key actions, and KPIs to watch.

The hard truth about AI implementation

Or…

Why CFO digital transformation is the only road to victory

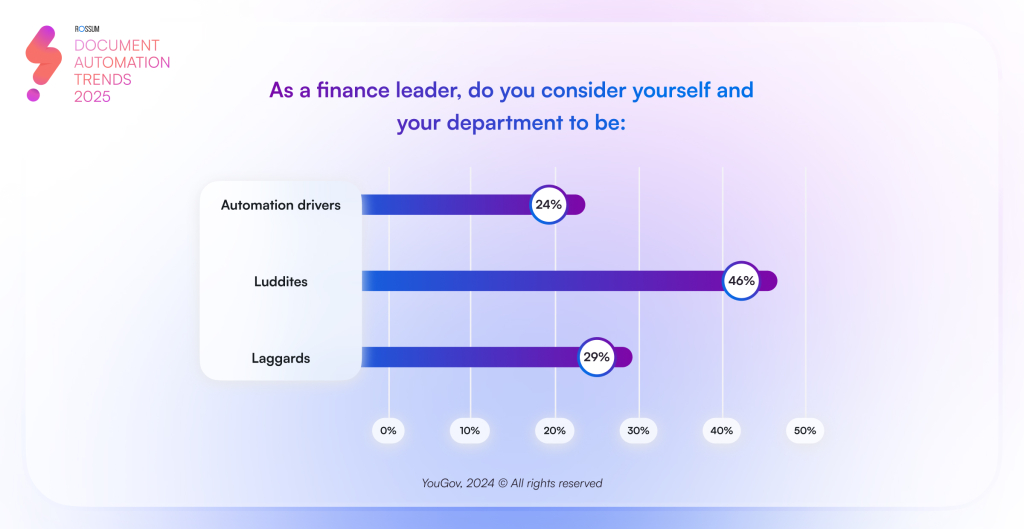

To be brutally honest, most finance leaders are failing at digital transformation. When 76% of finance leaders don’t see themselves as innovation drivers, we’ve a serious problem.

Rossum’s Document Automation Trends 2025 report.

This mindset isn’t just outdated – it’s dangerous. The traditional view of finance as a back-office function is dead. It just doesn’t know it yet.

We’re seeing three types of CFOs today…

- The ostrich burying its head in spreadsheets, praying that artificial intelligence is a passing trend

- The weekend warrior making token investments in point solutions without a long-term strategy

- The trailblazer embracing AI as a core competitive advantage

The gap between these groups is widening. Becoming an insurmountable chasm.

The cost of inertia is way higher than most realize. Research from McKinsey indicates that businesses adopting AI tools are experiencing significant benefits, including increased profitability and operational efficiencies. Its 2023 report highlights that companies using AI have seen notable improvements in various business functions. But the real costs go deeper…

Competitive erosion

- Market share loss to more agile competitors

- Declining profit margins from inefficient operations

- Reduced ability to attract top talent

Resource drain

Deloitte’s Finance 2025 report discusses the transformative impact of AI on finance operations. Predicting that automation and blockchain will lead to touchless transactions. Significantly reducing manual processes and associated errors.

While a survey by CFO Dive found that 76% of CFOs believe manual tasks waste time and effort in their finance teams.

Talent exodus

The 2024 LinkedIn Learning Report shows a significant shift in the finance sector…

- 67% of finance professionals prefer employers with advanced digital capabilities

- Top finance talent is three times more likely to leave organizations working with outdated technology

- 82% of finance professionals believe AI skills are crucial for career advancement

Strategic head-scratching

While you’re buried in manual processes, AI-powered competitors are…

- Accurately predicting market trends

- Automating most of their financial close processes

- Reducing forecast variance

The CFO digital transformation must-have

The CFO role has shifted profoundly. Research from Sage reveals that 85% of CFOs are expecting to take on a more substantial role strategizing future business outcomes. With 87% who have incorporated AI into their roles reporting a meaningful impact on their business. While NetSuite reports 38% of people are overwhelmed by their responsibilities.

This is not sustainable. Period.

Key actions for successful AI implementation

Based on my research of industry trends and successful implementations, here are the critical steps finance leaders must take…

Transform your operating model

Stop thinking about automation as a mere cost-saving tool. Start seeing it as your competitive edge. This means…

- Identifying high-impact use cases that transform and improve

- Building AI-first processes, not upgrading old ones

- Creating new value streams only possible with AI

Remodel your tech stack

Factors such as regulatory constraints and legacy systems will influence the pace of transformation across industries.

A survey by Salesforce found that 89% of financial services leaders believe that early adopters of autonomous finance will gain a serious competitive advantage.

These insights emphasize the need for finance systems to undergo significant upgrades to remain competitive.

“My advice for leaders is to approach automation as an essential part of digital transformation rather than an optional upgrade. When considering automation, it’s crucial to focus on scalability, integration capabilities, and user experience. A solution needs to fit into your existing infrastructure without creating new silos, and it should be flexible enough to adapt to future technology advancements.”

Joshua Conneely Technical Consultant @ MaxLogic

Rossum’s Document Automation Trends 2025 report

Revamp your talent strategy

According to Shannon Cole at Gartner, “Many CFOs are ill-equipped to identify and address the rapidly evolving digital skills needed in finance.” You need…

- Data scientists installed in finance teams

- Cross-training of financial analysts in AI capabilities

- Hybrid roles that blend financial and technical expertise

“Finance leaders should leverage off of data to drive decisions and hold people accountable. Include data in daily dashboards to set short term and long term goals for improving efficiencies and accountability.”

Kathleen Danilchick, CFO @ Atlas Real Estate Group

Rossum’s Document Automation Trends 2025 report

AI implementation in your business

Here’s my suggested roadmap for your AI implementation…

Groundwork

- Audit your current processes for AI readiness

- Identify high-impact, low-complexity use cases

- Build cross-functional AI literacy programs

Kick off

- Launch your first application of AI

- Start upskilling key team members

- Develop clear AI governance framework

Transformation

- Scale successful AI applications

- Grow your AI talent pool

- Create your long-term AI strategy

- Establish metrics for measuring AI success

Pitfalls to avoid

- Addressing AI as an IT project

- Focusing solely on cost reduction

- Underestimating change management needs

- Neglecting data quality

- Failing to align AI initiatives with your business strategy

“The trend towards AI-driven real-time decision support will be transformative for finance leaders, enabling them to extract immediate insights from document data to make faster, more informed decisions. To leverage this, finance leaders should focus on integrating AI tools with their existing systems to streamline data flow and ensure accessibility. Prioritize platforms that offer predictive analytics and real-time reporting, as these will enhance financial forecasting and risk management. Additionally, investing in training for finance teams on AI tools will be crucial, so they can efficiently interpret AI-driven insights and incorporate them into their decision-making processes.”

Shail Khiyara, Founder and CEO @ VOCAL Council

Rossum’s Document Automation Trends 2025 report

Why this matters now more than ever

The finance function is at a watershed. Research from Sage reveals…

- 79% of CFOs say problem-solving is crucial

- 78% recognize tech understanding as essential

- 85% have led future business strategy

Alarmingly, most finance leaders are still trying to solve tomorrow’s challenges with yesterday’s tools. This must change.

The future favors the fearless

I’ll be brutally honest. Again.

We live in a data-driven culture. If you’re not actively driving AI implementation in your organization, you’re actively choosing to become obsolete. The gap between leaders and laggards is not linear.

Goldman Sachs projects that AI investment could approach $200 billion globally by 2025, indicating a major financial commitment to AI technologies.

But, towards the end of 2024, only 6.1% of US businesses had integrated AI into their operations, suggesting that widespread adoption is still in its infancy.

Despite the limited current adoption, companies investing in AI are expected to experience substantial productivity growth. Goldman Sachs estimates that AI adoption could boost productivity growth by 1.5% per year over a 10-year period. Enhancing market valuations for these businesses.

So, every day you delay is…

- Another day your competitors race ahead

- Another day your team loses on manual tasks

- Another day you buckle behind the curve

Looking ahead

The next few years will be transformative for finance. Those who succeed will…

- Think beyond automation to innovation

- Build teams that merge financial and technical expertise

- Create new capabilities that weren’t possible before

- Lead their organizations into the AI future

Your choice. But remember. In five years, we’ll look back at 2024 as the year that separated the innovative CFOs from those who fell by the wayside. Which are you?

Document Automation Trends 2025

This post was inspired by Rossum’s Document Automation Trends 2025 report. A finance leader’s guide to digital transformation. Seven trends shaping document automation in 2025. Alongside a survey of 470+ finance leaders in the UK, US, and Germany. If you’d like to learn more about the trends and how to tackle them face on, download our DAT25 report. You’ll find insights from finance leaders, qualified analysis from global experts, automation statistics, key actions for success, and the KPIs to watch.

Methodology

The Document Automation Trends 2025 report draws from comprehensive research conducted through YouGov on behalf of Rossum. Our research framework combines quantitative survey data with comprehensive market analysis.

Primary research

Our core data comes from interviews with 473 finance leaders across three major markets…

- United Kingdom – 167 respondents

- United States – 156 respondents

- Germany – 150 respondents

Survey parameters

- Timeline – Two-week period, September 2024

- Respondent profile – Senior management and above

- Focus area – Finance and accounting decision-makers

- Survey type – Online interviews with pre-verified YouGov panel members

- Data analysis – Consolidated findings across all three markets

Secondary research

To provide comprehensive market context, we supplemented our primary data with extensive research from…

- Industry news platforms

- Professional forums and blogs

- Market analyst reports

- Industry expert insights

This dual research approach ensures our findings reflect both current market realities and emerging industry trends.

This post refers to a survey and report published in 2024. While this post is still relevant, be aware that if you download our document automation trends report, it’ll be the 2026 version. New stats. New trends. New KPIs. New expert opinions.