2026 Automation Statistics That’ll Upset the Finance Applecart

The automation experiment is over. In 2026, finance teams face a new mandate. Prove ROI or lose funding. Finance leaders aren’t lobbying for innovation budgets. They’re under pressure to reduce risk, meet tightening compliance demands, and stabilize processes as document volumes increase. Our survey in October 2025 of 450 finance leaders across the UK, US, and Germany exposes the disconnect between automation promise and automation performance, and reveals what separates teams consistently delivering measurable results from those stuck in partial automation.

Download our Document automation trends 2026 report to see more details behind these findings.

Meanwhile, a smaller group is speeding ahead – treating automation as a governed, measurable, connected capability. These automation statistics show where finance stands today, where it’s heading next, and why ‘good enough’ is no longer sufficient.

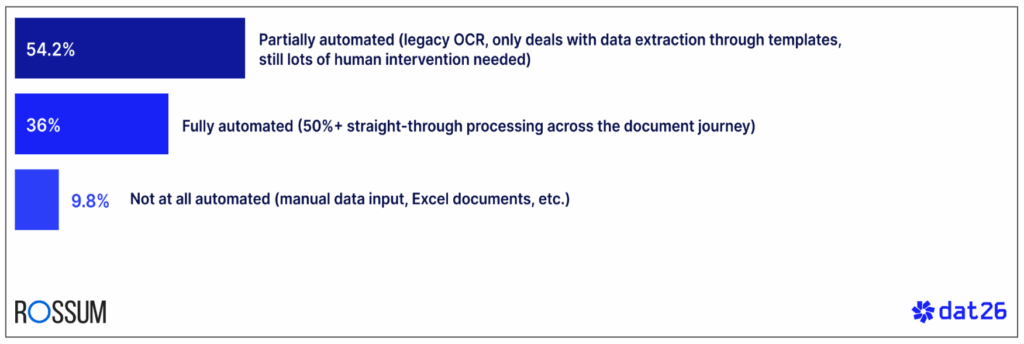

54.2% of finance teams are stuck in partial automation

Let’s start with the headline statistic. 54.2% of finance leaders say their processes are only partially automated, still relying on flaky, inconsistent OCR tools and human intervention. The remainder are split between teams that have reached full automation and those that haven’t automated at all.

To what extent have you automated financial processes within your department?

Only 36% have reached full automation

In practice, this means…

- Exceptions piling up because systems can’t understand document context

- Slow cycle times because workflows aren’t connected end to end

- Teams burning hours validating data that shouldn’t need human review

This partial automation has damaging consequences. Many respondents admit they lack…

- Clear KPIs for automation performance

- Systems that scale with document volume

- Confidence that processes won’t collapse under complexity

According to the survey, 33.3% of finance leaders say their existing tools can’t scale with increasing operational demands. This stat signals a deeper issue. Many systems weren’t designed for volume, variability, or governance requirements finance teams now face. This raises the question – are teams over-reliant on outdated tools, or is the underlying process structure no longer fit for purpose?

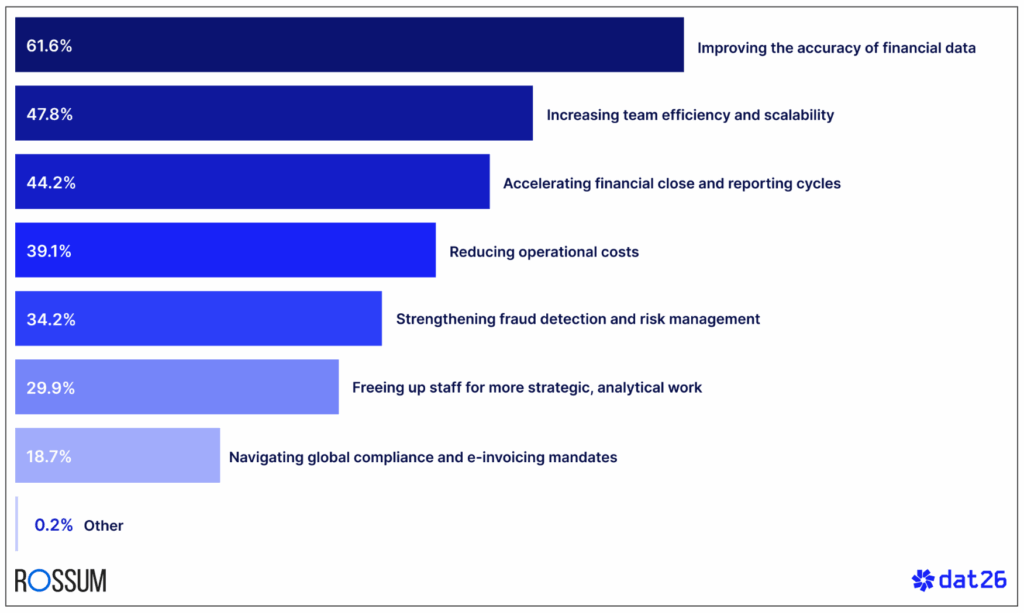

61.6% say accuracy matters more than speed

Finance teams are dealing with increasing risk coming from all directions. This risk exposure explains why accuracy – not speed – has become the defining metric for automation investment.

- Compliance obligations expand across borders

- E-invoicing mandates introduce new formats

- Fraud evolves faster than legacy systems detect it

- Manual reconciliation creates errors that are increasingly unacceptable

What are the primary business objectives driving your finance automation strategy?

Compliance and fraud drive accuracy demands

When asked what drives their automation strategy, 61.6% prioritized improving accuracy of financial data. Not efficiency. Not cost savings. Accuracy.

For finance teams, accuracy isn’t optional. It protects reporting integrity, reduces audit exposure, and prevents compliance failures at scale.

Errors cost more than delays

Accuracy is essential for trustworthy reporting, credible forecasting, clean audits, and resilient controls. And finance leaders know it. When asked about operational risks for 2026, respondents named compliance failures, incorrect financial data, and fraud exposure among their top concerns. All of which depend on accurate document handling.

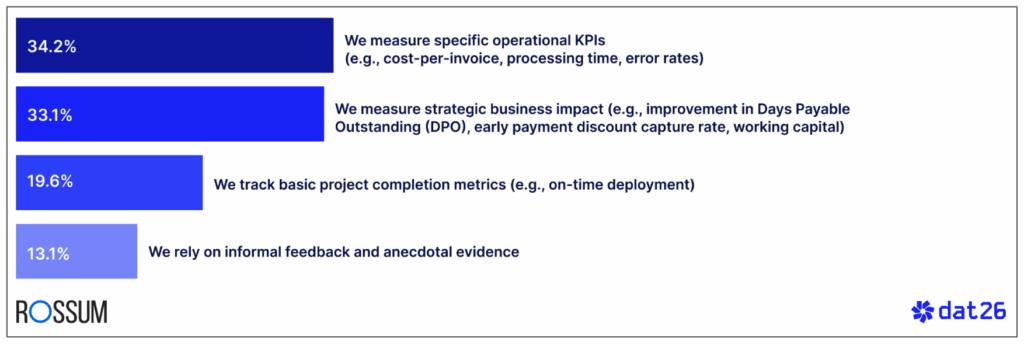

Operational KPIs replace AI hype for 34.2% of teams

AI gets measured now. The experimentation phase is over. Finance leaders are now applying scrutiny. They evaluate automation success through operational KPIs…

- Cost per invoice

- Processing time

- Error rates

- Exception rates

When evaluating AI/automation solutions, how do you primarily measure their success?

Cost per invoice processing time and error rates dominate

These four KPIs, tracked by 34.2% of respondents, align with the automation success framework outlined in our Document automation trends 2026 report. And give finance leaders a reliable, repeatable way to compare automation providers and justify investment.

Soft success metrics are no longer accepted

If automation doesn’t reduce costs, improve controls, and boost throughput, it fails. CFOs expect automation to prove its value in hard numbers – reduced error rates, faster cycle times, and lower cost per invoice.

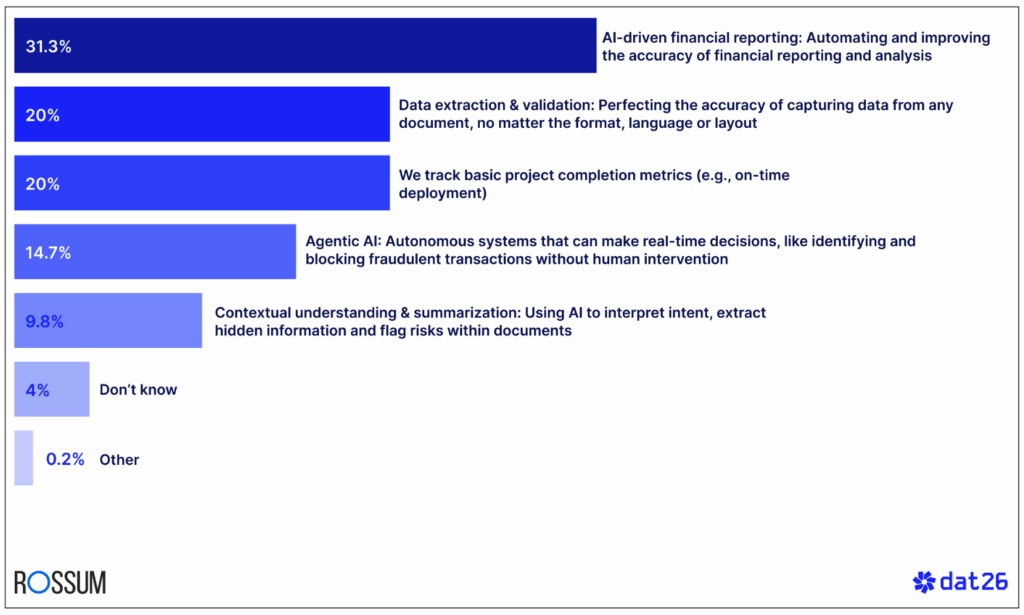

31.3% say AI-driven reporting will define finance performance

Automating document intake is now a standard capability. Every modern finance team expects baseline automation for reading, routing, and validating documents. What differentiates finance teams is their ability to spot anomalies early, forecast variances with confidence, and address issues before they affect financial reporting. Leaders want systems that identify risks before they disrupt operations, including…

- Earlier detection of anomalies

- Real-time forecasting

- Faster month-end close

- Scenario modeling that reflects business complexity

Forecasting and anomaly detection rise in priority

This explains why 31.3% identify AI-driven financial reporting as the capability with the biggest impact on operations. Proactive intelligence replaces reactive processing.

Looking ahead to 2026, which advanced AI capability do you believe will have the most significant impact on your finance operations?

33.3% are already pushing for hyperautomation

Point solutions create operational blind spots.

- Finance wants AP connected to procurement

- Procurement wants suppliers connected to onboarding

- Controllers want reporting tied to source data

- CFOs want visibility across the entire document lifecycle

Disconnected tools create operational blindspots

The isolation ends in 2026, as enterprises prioritize fully connected document lifecycles and consistent governance across teams. With 33.3% of leaders pursuing true hyperautomation that connects finance with procurement, customer success, and supply chain, the shift from fragmented tools to connected systems accelerates.

Organizations at advanced automation maturity consistently report lower exception rates, fewer manual handoffs, and faster approval cycles. These outcomes are recognized indicators of high-performing finance operations.

Trust breaks down without explainability for 35.8%

Blackbox AI destroys trust. When a system can’t explain why it approved an invoice or flagged an exception, it becomes a liability. Survey respondents reinforced this point. When asked what makes an AP system trustworthy, 35.8% demanded that systems reliably flag all exceptions while allowing standard invoices to pass straight through.

Human review isn’t going away. It’s being refocused. Manual eyes belong on exceptions, not everything. This redistribution of effort is what allows finance teams to scale without additional headcount.

This shift toward explainable AI drives investment in documentation standards, model traceability, audit-ready decision trails, bias testing, privacy safeguards, and role-based controls.

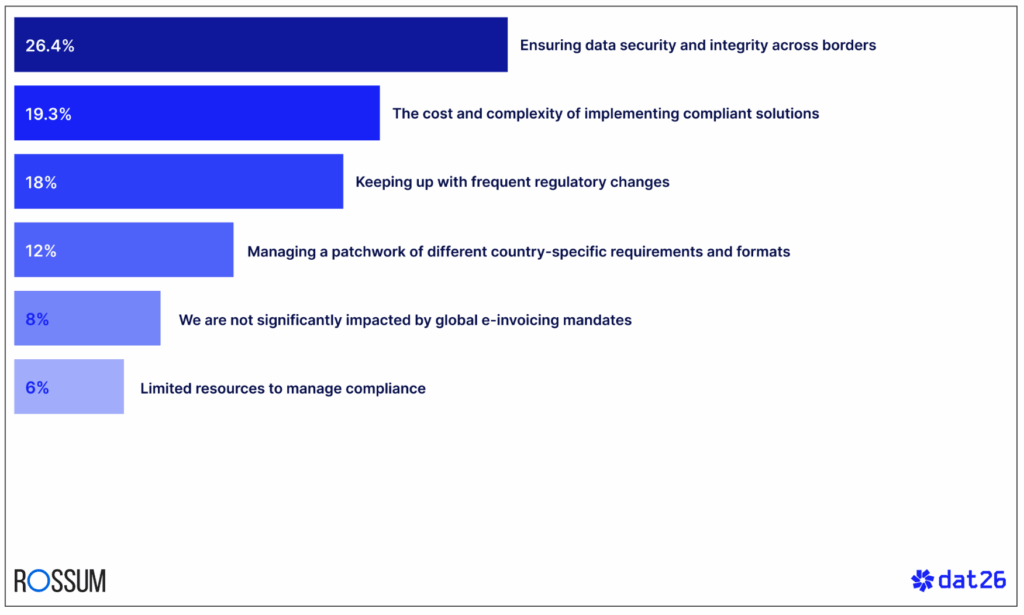

26.4% see cross-border data security as the biggest compliance risk

E-invoicing mandates are accelerating across the EU and beyond. Formats are multiplying. Regulatory obligations are tightening. And finance teams are feeling the pressure, with 26.4% saying their biggest concern with global mandates is maintaining data security and integrity across borders.

The survey also found that 30.7% view global compliance as one of the top barriers to scaling automation internationally.

As global e-invoicing mandates (e.g., in the EU) expand and impact the majority of businesses with international operations, what is your biggest concern?

And don’t think for a second it’s only about submitting compliant invoices. It’s also ensuring every document is…

- Complete

- Structured

- Validated

- Secure

- Traceable

- Accepted by foreign systems

This is why compliance readiness is no longer confined to AP. It now spans procurement, finance, legal, and IT.

The survey data shows that finance leaders are waking up to the fact that global compliance isn’t a documentation task. It’s an automation challenge.

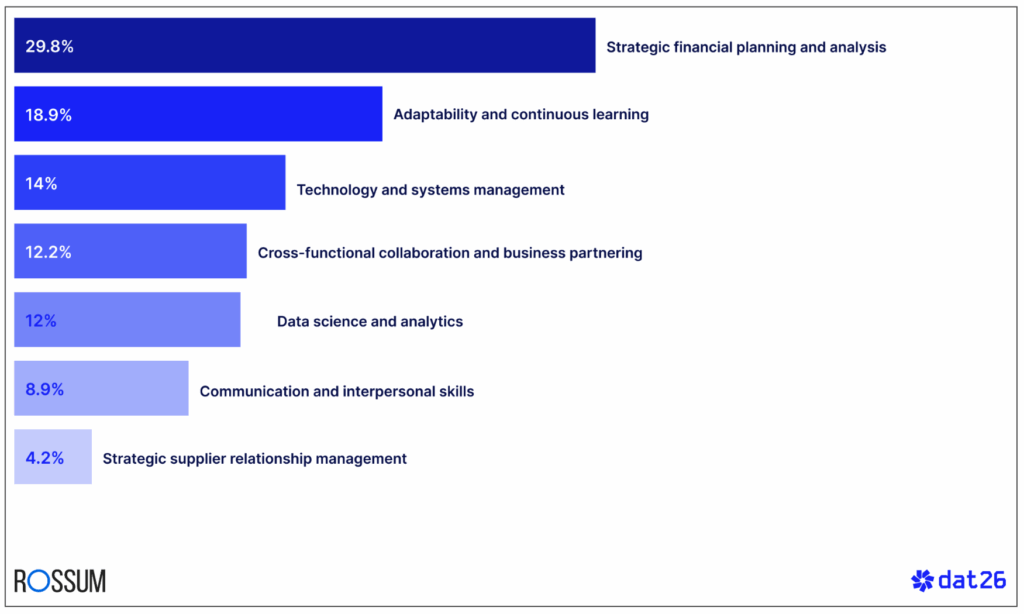

29.8% say strategy is finance’s most valuable skill

When automation takes over routine tasks, what becomes the most valuable finance skill?

According to our survey, 29.8% identified strategic financial planning and analysis as the most valuable future finance skill.

As automation handles more routine financial tasks, what becomes the most important skill for your finance team members?

There’s a pretty clear message. Automation is shifting finance roles toward higher-value analytical and strategic work.

Manual entry, status chasing, and copy-pasting are disappearing. Strategic thinking, scenario modeling, and decision support are emerging as crucial skills.

Teams that build these capabilities are better positioned to influence investment decisions and guide resource planning. These skills directly support the predictive, insight-driven operating models finance leaders say they want to achieve in 2026.

Our DAT26 report notes that teams investing in automation oversight and data interpretation skills are outperforming peers on accuracy, throughput, and cycle-time reduction.

The finance team of 2026…

- Designs automated workflows

- Oversees AI controls

- Interprets insights

- Communicates impact to their business

22% reject automation that’s powerful but painful to use

22% of finance leaders said the hardest barrier is finding an automation solution that’s powerful yet easy to implement and use. Proving that finance teams aren’t opposing automation. They’re resisting bad automation.

Finance leaders consistently reject systems that…

- Require heavy IT support

- Break when formats change

- Depend on constant template maintenance

- Fail to handle exceptions

- Don’t integrate with core workflows

Finance leaders must have solutions that scale, not ones that create more admin. If automation is cumbersome or opaque, adoption collapses, regardless of how advanced the core technology is.

Automation statistics across Germany, the US, and the UK

At first glance, finance automation maturity across Germany, the US, and the UK looks broadly aligned. Partial automation dominates in all three markets, and fully automated teams remain in the minority. A closer look at the automation statistics shows that the differences lie less in adoption levels and more in how teams prioritize automation, measure success, and define what automation should be.

Germany’s strategy is cautious but reaches 38% full automation

Germany stands out for its relatively high level of full automation. 38% of German finance teams report 50%+ straight-through processing across the document lifecycle. This is the highest level of full automation across regions, reflecting a more methodical, process-first approach where automation is implemented deliberately and stabilized before being expanded.

The same mindset shows up in priorities. German finance leaders are more likely to focus on accelerating financial close and reporting cycles (53.3%) and improving data accuracy (55.3%), rather than prioritizing aggressive efficiency gains or cost reduction. Automation here is viewed as a way to reinforce control, predictability, and reporting integrity.

This caution also rears its head in how German teams evaluate automation success. They are more evenly split between operational KPIs (30%) and strategic business impact metrics like DPO or working capital (31.3%). This split shows that German finance teams balance day-to-day execution discipline with longer-term financial outcomes.

Where Germany diverges most noticeably is in future-facing AI capabilities. AI-driven financial reporting ranks highest (34%), while contextual understanding and agentic AI remain lower priorities. This points to a preference for AI that strengthens core finance outputs before introducing higher autonomy.

Germany’s automation journey reflects controlled maturity – fewer leaps, more structure, and a strong emphasis on reliability over experimentation.

The US is outcome-driven and risk-aware with 37.3% tracking KPIs

The US finance landscape shows a different pattern. While fewer teams report being fully automated (32.7%), American finance leaders are the most likely to measure automation through hard metrics. 37.3% track operational KPIs such as cost per invoice and error rates, and 34% assess strategic business impact. Together, this gives the US the strongest emphasis on formal measurement across the three regions.

US respondents also show stronger momentum toward advanced AI capabilities. Predictive analytics (21.3%) and contextual understanding (12.7%) rank higher than in Germany, signaling a stronger preference for AI that informs decision making, not just processing transactions.

At the same time, US leaders display heightened awareness of automation risk. They are more likely to cite integration complexity (23.3%) and data security or AI governance concerns (20%) as blockers. This reflects a reality many US enterprises face – complex, multi-system environments where automation value depends on clean integration and trust in decision-making logic.

The US approach to trust reinforces this. 41.3% say an AP system is only trustworthy if it reliably flags all exceptions while letting standard invoices pass straight through – the strongest endorsement of exception-led automation across all regions. Autonomy is welcomed, but only when tightly governed.

Overall, US automation statistics describe a market pushing hardest on ROI, accountability, and intelligence – but aware that scale without governance introduces risk.

The UK pushes scale fastest with 40% targeting hyperautomation

The UK shows the highest automation ambition, paired with considerable pressure to deliver results at scale. While 37.3% of UK teams report full automation, a higher proportion remain partially automated (54%), often relying on legacy OCR and human intervention.

What distinguishes the UK is why teams are automating. Increasing team efficiency and scalability is the dominant driver at 59.3%, far outpacing Germany and the US. This reflects a workforce reality – UK finance teams are under sustained pressure to handle growing volumes without proportional headcount increases.

That urgency also explains why the UK leads in hyperautomation ambition. 40% of UK finance leaders say their goal is true hyperautomation across departments, significantly higher than Germany (27.3%) and the US (32.7%). The UK isn’t merely automating AP – it’s trying to connect finance, procurement, and adjacent functions into a single operational unit.

Trust expectations differ too. UK leaders are less focused on exception-only models and more likely to demand transparent, human-readable audit trails at 42.7%, the highest of all regions. This aligns with strong regulatory scrutiny and a compliance culture that prioritizes explainability over speed.

UK respondents also express heightened concern about keeping up with regulatory change (22.7%) and AI governance (24%), suggesting that ambition is muted by the realities of evolving mandates and risk exposure.

In the UK, automation ambitions are higher, but so are regulatory and operational constraints. Automation must scale, explain itself, and adapt continuously to stay viable.

What these regional automation statistics reveal

Across all three markets, finance automation has moved beyond adoption and is now defined by local risk, operational scale, and governance requirements.

- Germany prioritizes stability, reporting integrity, and structured rollout

- The US optimizes for measurable ROI, predictive insight, and governed autonomy

- The UK pushes hardest on scale, connectivity, and auditability under regulatory pressure

One clear pattern emerges across all three regions. Partial automation is no longer sustainable, regardless of region. But the journey out of it looks different depending on the regulatory environment, operational scale, and risk tolerance.

For global finance leaders, these differences matter. Automation strategies that succeed in one region may fail in another unless they account for local priorities around trust, governance, and performance measurement.

Advanced finance teams are building automation frameworks that adapt to regional realities, while still delivering consistent, measurable outcomes at scale.

What these automation statistics mean for finance leaders

Across every data point, one theme emerges – 2026 is the year automation must prove ROI, or it won’t get funded.

Automation maturity now determines operational resilience – and finance leaders are under pressure to demonstrate measurable, repeatable improvements. To secure investment and scale safely, finance teams must operate with…

- Measurable success metrics

- Stricter governance

- Cross-functional alignment

- Global compliance readiness

- Proactive risk detection

- Predictive intelligence

- Scalable systems that grow with volume

This year’s automation statistics raise a red flag – finance teams that treat automation as optional will fall behind those treating it as essential infrastructure.

What’s next?

Our Document automation trends 2026 report breaks down…

- The 7 trends redefining automation performance in 2026

- The shift from reactive processing to predictive operations

- The operational KPIs that matter most

- The governance required to scale AI safely

- How AI is reshaping fraud prevention through anomaly detection, supplier-risk scoring, and real-time document analysis

- The future skills finance teams must build now

Finance leaders want clarity, not hype. Proof, not promises. Our DAT26 research shows a consistent pattern – accuracy, control, and fraud reduction are now the defining ROI metrics for automation funding. Finance leaders are prioritizing automation that reduces risk, increases accuracy, and accelerates decisions.

Our DAT26 report gives finance leaders a data-driven view of what high-performing teams are doing differently. And the operational benchmarks needed to stay competitive.

Methodology

Our report draws from comprehensive research conducted through Appinio on behalf of Rossum. Our research framework combines quantitative survey data with comprehensive market analysis.

Our DAT26 report surveyed 450 finance leaders across the UK, US, and Germany for a two-week period in October 2025. Respondents represented senior management and above, and included finance and accounting decision makers across all industries.

Document automation statistics infographic

If you’d like to learn more about the trends and how to work with them, download our DAT26 report. You’ll find insights from finance leaders, qualified analysis from global experts, key actions for success, and the KPIs to watch.

Spoiler!

Check out our cracking automation statistics infographic…