Automating the End-to-End Process of Accounts Payable | 14 Tips

Looking to automate the end-to-end process of accounts payable but not sure where to start? To take back all the hours your AP team wastes on manual data entry? I’ve drawn up a list of AP automation tips. By the end of this post, you’ll have a clear understanding of how to automate your AP process and transform your finance department from a cost center into a strategic asset…

Download your free eBook… Your AP Automation Wake-Up Call.

Calculating the Cost of Doing Nothing [2025 Edition].

Your business becomes irrelevant. Your competitors leave you standing. You’re done.

What is AP automation?

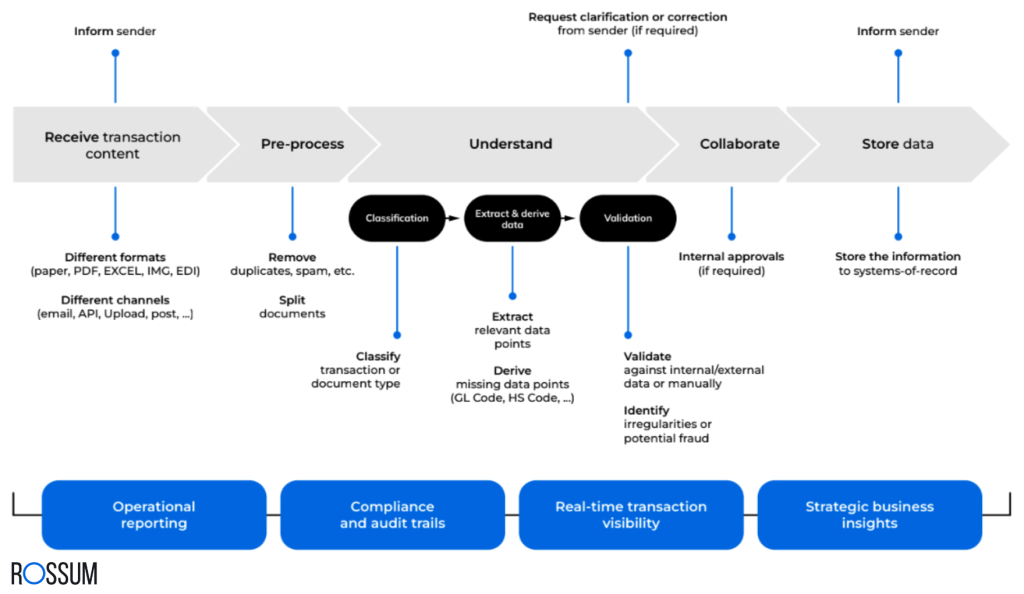

Accounts payable automation minimizes manual processes by digitizing tasks such as invoice processing, payment approvals, and payment disbursement. Using an AI document processing solution to perform repetitive manual data entry workflows.

AP automation typically combines several technologies…

- Optical character recognition – OCR – to extract data from invoices

- Machine learning algorithms for document classification

- Robotic process automation – RPA – for workflow routing

- Integration with ERP and accounting systems

Automating the end-to-end process of accounts payable leads to higher rates of accuracy, increased customer retention, and happy vendors. It provides better visibility and more control over essential financial processes.

Manual data extraction

| $2.03 per invoice | 105 keystrokes per invoice | 111 seconds per invoice |

| 12.5% invoices needed rework | 3,840 invoices per month per FTE | 5.5 minutes to rework invoice |

Manual invoice processing is inefficient, expensive, and boring.

Table of Contents

Benefits of automating the end-to-end process of accounts payable?

Assuming you already know the benefits of going the automation route and just want to read the AP automation tips, I’ve kept this brief.

The main benefit of automating the procurement process is… increased profits. Other benefits of AP automation include…

- Save time – eliminating the manual stages of invoice processing will speed up your workflows end to end

- Save money – reduce labor costs, along with the cost of postage, paper usage, document storage, delivery costs, invoice production, etc.

- Improved efficiency – invoice automation software reduces approval times and increases productivity

- Improved cash flow management – automation allows companies to track and manage the payment process, avoiding duplicate payments and paying suppliers and vendors on time

- Increased accuracy – fewer humans in the loop reduces the level of errors

- Compliancy – built in rules mean suspicious activities and fraud can be flagged

- Reduce employee churn – no more boring, repetitive tasks to kill your team’s spirit

- Increased visibility – automation allows companies to track payments in real time

Example of accounting automation.

If you’d like to learn more about the many benefits of automating your AP processes, take a look at Best Accounts Payable Automation Software. It goes into detail about the AP process, benefits, which tasks can be automated, ROI, and a whole lot more.

Industry benchmarks – how does your AP process compare?

Before we dive into automation tips, let’s look at where your business might stand compared to others…

| Metric | Manual processing | Automated processing |

| Average cost per invoice | $10-15 | $2-5 |

| Processing time | 8-20 days | 1-3 days |

| Error rate | 2-5% | <1% |

| Team time on data entry | 60-70% | 10-20% |

According to the Institute of Finance & Management, top performing AP departments process 12,500+ invoice per FTE annually, compared to 5,000 for typical departments. Where does your team land?

14 tips for automating your AP process end to end

Check out my tips for automating the end-to-end process of accounts payable. AP best practices that’ll not only help you avoid expensive mistakes, they’ll also ensure you reduce costs, create frictionless processes, and drive a healthy ROI.

Let’s go…

1. Align AP automation with your business objectives

Your automation objectives must align with your business objectives if you want to achieve success. Understanding the objectives, challenges, and priorities will help you find areas where automation will bring value.

With today’s unstable economy, aligning your new technology strategy with your business objectives becomes a priority.

According to KPMG, 66% of organizations have been effective in using digital to advance business strategy. With 50% seeing ROI from AI technology investments.

2. Choose your AP automation goals

Accounts payable automation goals will vary according to your needs and pain points, culture, and overall business strategy. There are a heap of goals that apply across the board, including…

Increase accuracy

Choose areas where you’d like to see increased data accuracy, with specific time periods for improvement.

Save time

Automate repetitive tasks and standardize operations to free up your team to spend more time on strategic initiatives for competitive growth. Resulting in increased efficiency and employee satisfaction.

Increase early payment discounts

Paying invoices punctually not only affects your cash flow as you’ll benefit from early payment discounts, it also strengthens your reputation with vendors and suppliers.

Reduce costs

Areas in which you can save money can include reduced labor costs, as your team reduces time spent on low-value, repetitive work. Punctual payment of invoices to benefit from early payment discounts.

Improved performance

Performance goals could include…

- Meeting compliance

- Reduced employee churn

- Increased efficiency

- Reduced manual errors

- Reducing costs

Eliminate AP backlogs

Automating your AP processes so they’re faster will eliminate your accounts payable backlog and reach a higher turnover ratio.

Setting firm goals will help you determine what’s working and what isn’t, so you can…

- Share the potential outcome when you pitch to stakeholders

- Measure your success during the project

- Identify which vendor can provide an AP automation solution to suit your business

- Keep your team in the loop throughout your automation journey

3. Create an implementation strategy

You need an implementation plan that explains the details of your automation project. Workflows to be automated, timings, onboarding, training, etc.

4. Typical AP automation implementation timeline

When planning your accounts payable automation journey, understanding typical timelines helps set realistic expectations…

- Assessment and planning – 2-4 weeks

- Vendor selection – 4-6 weeks

- System setup and configuration – 2-3 months

- Testing and training – 3-4 weeks

- Full implementation – 1-2 months

Most organizations can complete end-to-end AP automation implementation in 4-6 months. Complex global enterprises with multiple systems may require longer.

5. Choose a project leader

Designate a team leader to manage your automation project. A point of contact for progress, challenges, questions, and successes. Someone who’ll oversee the entire process and keep everyone on the same page. Clear communication and reduced bottlenecks.

6. Map your workflows

Improving your AP processes and workflows starts with a full evaluation of your current accounts payable process. Whether you use a whiteboard, workflow mapping software, or Post-it notes, this will help you identify areas that can be automated, communication bottlenecks, and inefficiencies. For instance, if your approval process is slow you could implement automated invoice approval workflows.

Need more information on How to do Workflow Process Mapping, check out our recent blog post.

7. Quiz your AP team

Before you implement any automation in your AP process, you must talk with the people involved. Your AP team. Your investment in new technology should benefit the entire company, particularly those working with your current manual processes.

Ask your AP team for feedback on…

- What’s working in our existing processes?

- What are the sticking points in our existing processes?

- Which areas could be improved with automation?

- What concerns do you have about automating processes?

8. Get key stakeholders onboard

Making changes to business processes is always a challenge. Add to that the introduction of new technology, and it becomes more complex.

For a smooth implementation, stakeholders must support the change. From your CEO to your team, they need to understand how automation will increase productivity. How changes will support business goals and achieve an ROI.

Work closely with your key decision makers to demonstrate how an automated AP process will reduce inefficiencies and improve your company’s reputation, customer satisfaction, and bottom line.

9. Keep vendors & suppliers happy

It’s vital you maintain strong relationships with your vendors. They’ll be more likely to support any changes you implement to AP workflows if they’ve been kept in the loop.

List the main suppliers with whom you place purchase orders and vendors who consider you a large customer, then let them know what’s going to happen. Some AP automation softwares let you set up a vendor access portal so they can update their details and follow the status of invoices.

10. Choose the right automation software

It’s true. There are a lot of document processing automation software options on the market. It’s important that you choose the one that meets your specific business needs and automation goals.

You should consider the processes you want to automate, cost, features, and whether it’ll integrate with your existing finance tech stack. Scalability of the software is also a factor so it’ll scale and grow as your company grows.

When evaluating potential automation vendors, consider these critical factors…

- Integration capabilities with your existing systems

- Capture accuracy rates – look for 90%+ extraction accuracy

- Security certifications – SOC 1/SOC 2, ISO 27001

- Implementation support and training offered

- User interface simplicity and learning curve

- Customer support availability and response times

- Future development roadmap alignment with your needs

Don’t just focus on price. The cheapest option often costs more in the long run because of hidden fees and manual workarounds.

How to Write an RFP for Intelligent Document Processing will give you more information about how to choose the best vendor, along with an RFP template you can customize to your business.

11. Centralize AP data

Still working with mountains of paper? Over stuffed filing cabinets? Countless spreadsheets?

Time to play catch up.

You need a single source of truth. A centralized data storage system. This will ensure that your data is accessible to team members. Secure. Current.

12. Track your KPIs

Tracking AP metrics helps you measure and analyze results for improvement. Failing to monitor your KPIs means you could fall down an expensive rabbit hole.

Accounts payable metrics to track include…

Average invoice processing cost

This one’s tough. Not all invoices are straight-through processes. Obviously, manual invoice processing is not only slower, it’s more expensive.

Automating will save you money, but there is still a cost.

Companies with complex manual accounts payable process flows can spend up to $50 to process one invoice, with a simple manual process costing about $6 to $8 per.

(Late fees + labor costs + postage + missed discounts + human error + data storage costs)

➗

(the number of processed invoices)

〓

Cost of manually processing an invoice

Average invoice processing time

If it takes an age to process an invoice, it means your accounts payable department is stuck performing low-value tasks. Depending on the type and size of your organization, the typical processing time per invoice is three to four days. Worst case scenario? Up to 20 days!

You do the maths!

Discount captures vs offered

An automated AP process ensures invoices are processed faster, which means you can take advantage of early payment discounts. Monitor how many discounts, along with the monetary value, your vendors are offering against how many your business receives.

Automate your AP process and you’ll receive automatic notifications as to when a discount is about to expire, so you can make your payment.

Late payments and penalties

This is a metric you must not ignore.

Your business can lose a lot of money due to late payments and penalties. You’ll also damage vendor relationships and your reputation.

Compare the number of invoices paid on time against those that are late. This is your benchmark to monitor your performance. While 100% punctual payments is a high bar, your goal should be to avoid late payments and penalties.

Supplier inquiries, discrepancies, disputes, fraud

Generative AI is Fueling a Surge in Invoice Fraud… discuss.

If your team is swamped with manual tasks, multiple inefficiencies will surface. Automating your purchasing and procurement processes will minimize the number of supplier interactions, thereby reducing the chances of human error.

Working with manual processes in your accounts payable department makes it vulnerable to invoice fraud.

For more information on fake invoices, recognizing red flags, and avoiding being hit by an invoice scam, check out How To Identify Fake Invoices.

Percentage of straight-through invoices

Straight-through invoice processing is when you receive, approve, and pay automatically. This type of invoice is faster and cheaper to process than invoice exceptions.

Invoice exceptions require humans to manually rework before approval. This can lead to late payments, increased costs, and dissatisfied suppliers.

An automated process to deliver invoices into your AP system increases your straight-through invoice processing rate, lowering overall costs.

ROI on accounts payable automation

When considering automation, you need to balance the cost reduction with the potential ROI from improving the efficiency of your AP process. Yes, they’ll be a financial investment, and it’s crucial that you’re able to prove that this investment is worth it. Compared with the cost of doing nothing.

Here’s a simple formula to estimate your potential savings…

Annual savings = (current cost per invoice – expected cost after automation) x annual invoice volume

For example, if you process 10,000 invoices per year at $15 each, and automation reduces this to $4 per invoice… ($15 – $4) x 10,000 = $110,000 annual savings.

Pretty good, no?

Factor in implementation costs to calculate your breakeven point. Most companies see ROI within 6-12 months after implementation.

Don’t sacrifice end-to-end AP process improvements for cost savings. Our Cost Of Doing Nothing | Zero In On Accounting Automation eBook explains the potential damage to your business of sticking with manual document processing. Including team burn out, increased employee churn, reduced revenue, productivity downtime. Worth a read!

13. Overcoming common AP automation challenges

There are going to be hiccups in automating the end-to-end process of accounts payable. Anticipating and preparing for these common implementation hurdles will accelerate your automation journey while maximizing ROI. Here’s how to navigate potential issues.

- Integration difficulties

Select vendors with proven integration experience with your specific ERP/accounting system - Employee resistance

Involve team members early and emphasize how automation eliminates boring tasks, not jobs - Supplier adoption

Provide clear communication and training for suppliers on new invoice submission methods - Exception handling

Ensure your solution includes strong tools for managing non-standard invoices - Data quality issues

Plan for a data cleansing phase before migration to the new system

14. Ensuring compliance through end-to-end accounts payable automation

Finance leaders increasingly face regulatory pressure across multiple jurisdictions. AP automation helps maintain compliance by…

- Creating consistent, secure audit trails

- Enforcing separation of duties

- Providing real-time visibility into invoice status

- Supporting tax compliance with automatic validation

- Reducing fraud through automated matching and exception flagging

- Ensuring retention policies are automatically enforced

Time to take the pressure of your AP team

Automating the end-to-end process of accounts payable will bring substantial benefits to your company. Time saved. Money saved. Sanity saved.

Implementing an automated AP process doesn’t stop there. Use these AP automation tips to continuously review and improve the process.

Accounts payable automation FAQs

Yes, many organizations start with invoice capture and approval workflows, then add payment automation at a later date. A phased approach often provides better adoption rates.

Rather than reducing headcount, most organizations reassign AP team members to higher-value activities like vendor management, cash flow optimization, and financial analysis.

Choose a vendor with strong security certifications (SOC 2, ISO 27001), implement role-based access controls, maintain audit logs of all activities, and ensure data encryption. Regular security assessments are also recommended.

Advanced accounts payable platforms use machine learning to recognize patterns in exception invoices. Flagging exceptions for human review while continuing to process standard invoices automatically. The system learns from each exception, reducing the need for manual intervention over time.

Focus on invoice processing costs, cycle times, exception rates, early payment discount capture, and straight-through processing rates. It’s also beneficial to Many organizations also track team satisfaction and redeployment of resources to strategic tasks.