Why AI in Accounts Payable Needs New KPIs

Invoice processing time. Cost per invoice. Touchless processing rates. These operational KPIs have, until now, defined success in AP automation. But they don’t explain why the impact of AI in accounts payable is still being questioned in the boardroom. For years, automation in finance has been measured by how much faster or cheaper a task gets done. And that made sense when the task itself was the problem – manual data entry, lost invoices, late approvals, missed discounts. Today, AI is solving those problems. The challenge – and opportunity – is in measuring what that efficiency enables across your business.

From Bottleneck to Powerhouse: Unlocking Strategic Value in Accounts Payable Through AI. A data-driven research document offering insights on technology, market trends, and business strategies – sponsored by CrossCountry Consulting and Rossum.

The process isn’t the problem. It’s how we measure the impact.

When AI is embedded in AP, the questions shift. The work gets faster, yes. The approvals move, the exceptions dwindle, the matching improves.

At the executive level, performance metrics must tell the bigger story. One that connects operational improvements to strategic business results.

- Why can’t we link AP improvements to working capital gains?

- What’s the strategic value of these tools?

- Where is the ROI?

Automation may still live in accounts payable. But the value appears elsewhere. And that’s where the metrics are moving.

Why AI in accounts payable needs new KPIs

The old metrics were mechanical. They measured the process in isolation. How long? How many? How accurate?

According to the IDC InfoBrief, by mid-2026, 60% of the world’s largest organizations will have adopted new KPIs to align AI-infused processes and workflows, leading to measurable improvements in efficiency and productivity. This is the reality finance leaders face today. Automation is only valuable if its impact reaches beyond process efficiency.

As AI becomes the norm in accounts payable workflows, finance leaders are seeing more than just faster processing. They’re seeing smarter decisions, stronger supplier relationships, and more control over cash.

But if those outcomes aren’t being measured, the value remains invisible.

New KPIs are emerging that reflect what AI-powered AP teams enable. They track the effect. Not just within AP, but across the business.

These metrics…

- Help CFOs justify automation investments

- Link operational gains to business-wide outcomes

- Make finance’s strategic value clear to executive leadership

Why old AP automation metrics fall short

Old efficiency KPIs included…

- Invoice approval time

- Purchase order matching rates

- Cost per transaction

Useful. But incomplete.

Outcome-focused AI in accounts payable KPIs

New efficiency KPIs focus on outcomes…

- Early payment yield

Are we using payment timing to drive early payment discounts or support supplier cashflow? - Forecast accuracy variance

Is our visibility into upcoming obligations improving? - Cash optimization opportunity rate

How often are we able to align payments with treasury goals? - Duplicate detection rate

How many duplicate invoices are detected each month, and from which suppliers?

For example, invoice approval time doesn’t capture whether the payment was well timed. Early payment yield does. It asks whether your finance team was able to use timing as leverage. Pay early when cash is available and discounts are attractive, or hold payment to improve liquidity when needed.

The duplicate detection rate metric not only prevents overpayments but also

flags potential supplier process issues or fraud risks.

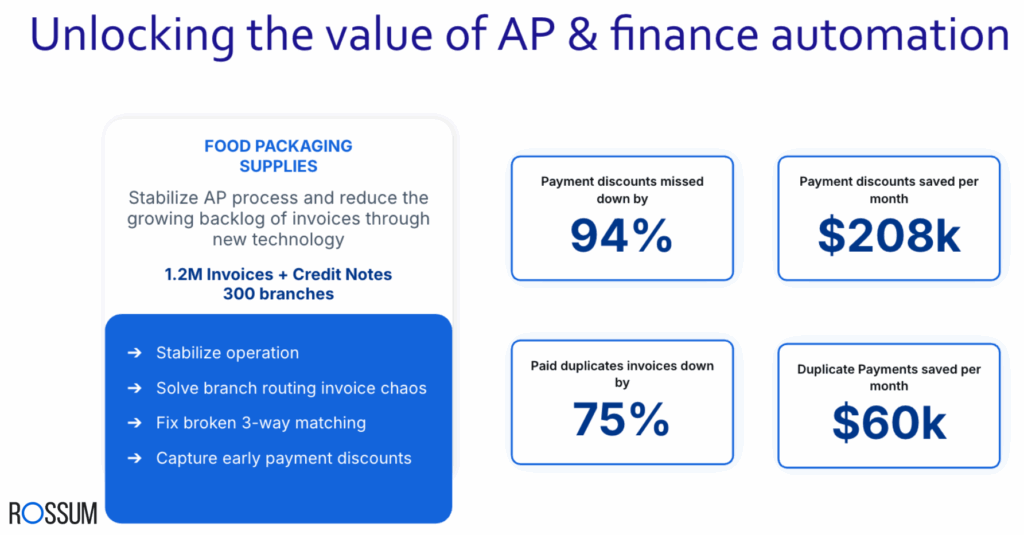

Image source: Clearsulting and Rossum webinar.

Top finance teams are no longer focused on automating everything. They’re focused on understanding where and when automation gives them the edge.

When you let AI handle the standard tasks, your team reclaims time. It shouldn’t be measured as a labor saving. It’s time that can be invested in tasks that ask for judgment. For instance…

- Supplier negotiations

- Finding ways to reduce dependency on fixed payment terms

- How to use data to hone cash flow forecasting

So we don’t look to measure straight-through processing. Rather, how many improvements your AP department creates for your business.

This is where traditional AP metrics meet their limit, and where finance leaders must turn to outcome-driven KPIs.

Here’s how to connect AP automation metrics to business-wide results.

Aligning KPIs with business objectives

Accounts payable leaders are reporting faster cycles and higher accuracy. But CFOs are being asked about free cash flow.

Many AP teams still measure their work in isolation. The automation works. But value is determined by results that don’t live with the AP process where the technology is employed.

How do we close this disconnect? We change the metrics.

Instead of chasing process benchmarks, track KPIs that bridge teams, such as…

- Invoice data readiness

Is our AP data being used in treasury and forecasting workflows? - Payment timing impact on working capital

Are we making payment decisions that improve liquidity? - Cash forecasting lead time

How early can finance deliver accurate forward views?

These metrics connect AP to cash, risk, and strategy. A narrative the board understands. They demonstrate the needs of treasury, procurement, supply chain, or the CFO. KPIs that are hard to ignore.

They don’t describe what automation does. They describe what automation enables.

Supplier experience is no longer a soft metric

If your suppliers are paid on time, disputes are reduced. It’s easy to measure.

When your suppliers are paid early – because finance has the data to decide when early payments deliver the most value – that’s a different proposition. It’s the optimization of payment terms for mutual benefit.

AI in accounts payable can strengthen supplier relationships. With accurate data and stable processes, your finance team can offer consistency. Predictable payments. Fewer escalations. Less uncertainty.

You build trust.

And if disruptions hit – supply chain constraints, raw material volatility, geopolitical events – that trust is currency.

Measure the supplier experience through finance KPIs…

- Supplier payment predictability

- Reduction in supplier disputes or escalations

- Average days early – voluntary, not enforced

- Supplier satisfaction with payment process

- Participation rate in early payment programs

When structured well, early payment programs can strengthen supplier relationships and improve cash positioning, creating a win for both sides.

Not soft metrics.

These are indicators of supplier resilience – their ability to withstand and recover from disruptions. Critical insights in an unpredictable supply chain environment, especially across sectors such as manufacturing, retail, B2B distribution, and consumer goods.

Just as stronger supplier relationships improve resilience, AI is also reshaping the work experience for finance teams. Transforming how organizations attract and retain talent.

The talent impact of AI in accounts payable

Talent retention is no longer a metric exclusive to HR.

Finance teams lose good people for one main reason. They’re bored. Exception handling. Manual entry. Data validation. This kind of work invites error, not talent. It exhausts skilled staff and blocks strategic thinking. Your team burns out.

AI automation removes the grind. You’re not measuring whether automation did the work. The metric is whether automation improves the work experience.

Organizations that implement intelligent document processing in their finance operations should track how AI in AP affects team performance and engagement…

- Time spent on exceptions per AP analyst

- Percentage of team time spent on high-value tasks – analytics, strategy, collaboration

- Internal mobility or promotion rates within finance

- AP team engagement scores

- Training hours invested vs hours consumed by manual processing

AI-enabled AP teams can also attract more skilled candidates by offering higher-value work from day one, helping finance leaders compete in the highly competitive finance talent market.

These are people-first metrics that speak to CFOs who are under pressure to retain talent, not replace it.

Automation doesn’t replace people. It changes what people do. The metric is whether those people are now doing something that moves the business forward.

This shift is central to finance’s role in digital transformation. Measuring the human impact is as important as measuring the technological one.

Faster decisions, smarter finance

Data is only useful if it’s fast. Most of the friction in finance decision-making comes from document-based data that’s either late, wrong, or missing.

Think of how many decisions are delayed because you’re waiting for an invoice to be validated. Or a purchase order reconciled. Or a supplier discrepancy cleared.

When AI ingests and interprets documents accurately – whether invoices, contracts, or payment requests – delays are reduced. Decision makers get access to data that’s current, structured, and consistent.

The metrics to track include…

- Decision delay – time from data availability to executive action

- Forecast input reliability score

- Volume of decisions made using live AP data

- Reduction in ad hoc data requests from the AP team

When your accounts payable team becomes a source of insight, decision making is faster and more accurate. Affecting everything from budgeting to mergers and acquisitions.

What your board wants to hear

The traditional automation story is so tired. Boards have heard it all before. They’ve approved the funding. They’ve seen the implementation. And… they’re still waiting to see the impact.

The automation didn’t fail. But the metrics didn’t shift away from the process.

Boards don’t care how efficiently something is done. They care what that efficiency enables.

- Working capital

- Agility

- Forecast accuracy

- Supplier resilience

- Talent retention

Because these outcomes influence profitability, resilience, and market positioning, they’re directly tied to investor confidence and shareholder trust.

And these are the KPIs that must be prioritized if finance leaders – if you – want to own the automation narrative.

Because the reality is that the work has changed. The tools have changed. And now, the definition of success must change too.

How to remodel your finance KPIs

Don’t throw out your existing metrics – invoice accuracy, cycle time, touchless rates. They still have value, but they’re not enough. If you want to show the business value of AI in accounts payable, incorporate KPIs that reflect what automation unlocks.

Kick off with…

- Audit your current AP metrics

Identify which ones measure process, and which ones measure impact. Make sure every automation improvement has a business-facing KPI. - Talk to stakeholders

Ask treasury and procurement where finance process delays are slowing their work. Ask your team what’s better because of automation. Not faster. Not cheaper. Better. - Define outcome-focused metrics

For every process improvement, identify a business-facing KPI that would reflect its value - Align KPIs to board priorities

Choose metrics that speak to margin, resilience, forecast accuracy, and capital efficiency. Ask what decisions they’re making with more confidence. What options they can see that they couldn’t see before. What risks are easier to manage. - Report cross-functionally

Share new metrics with other teams. Show how your accounts payable team is contributing to shared outcomes. This cross-functional visibility secures buy-in for future technology investments and positions finance as a strategic partner.

Measure those things. Because if your metrics still describe the process, you’re not measuring the value. Your board will continue to ask – what’s all this automation delivered?

When finance can show how AI-driven AP workflows are improving cash flow management, strengthening supplier trust, keeping talent engaged, and enabling faster decisions, the conversation shifts.

This is where forward-looking finance teams – in industries from technology to B2B distribution, manufacturing, and services – are headed. These are the metrics they’re watching.