Working Capital Optimization for Predictable Cash

Working capital optimization is a game of speed that manual workflows consistently lose. For a finance team managing $50M in monthly supplier spend, slow approval chains can cost up to $1M a month in missed early payment discounts. That delay traps capital that could fund growth initiatives or reduce reliance on external financing. Intelligent automation removes these leaks, turning accounts payable from a cost center into a predictable engine for liquidity.

Download your free eBook… Calculating the Cost of Doing Nothing.

Your business becomes irrelevant. Your competitors leave you standing. You’re done.

Most finance leaders track cash digitally – but the processes that move it often sit outside planning and forecasting systems. That disconnect turns predictable working capital into a reactive scramble. Cash is released too early or too late, repeatedly, at scale.

This is where document automation becomes essential. By capturing, validating, and routing invoices, orders, and statements automatically, intelligent document processing shortens cycles, reduces errors, and gives finance teams the control they need.

For wholesale distributors, where margins are tight and invoice volumes are relentless, the impact is immediate. The same benefits apply across manufacturing, retail, logistics, healthcare, and professional services. Anywhere complex procure-to-pay or order-to-cash processes govern cash flow.

My post is for finance leaders who already track working capital metrics but struggle to turn insight into action. You’ve got the dashboards and KPIs, but unexpected delays, errors, and exceptions still disrupt cash flow, hide risk, and force reactive decisions. Here, I break down the bottlenecks in accounts payable, accounts receivable, and inventory workflows, and explain how intelligent document processing gives you back control.

Explore how PwC and Rossum show finance leaders how intelligent document processing accelerates workflows, improves accuracy, and unlocks working capital.

Table of Contents

- What is working capital?

- How working capital is measured

- Where working capital control breaks down

- Optimizing working capital with document automation

- Accounts payable | Deciding when cash leaves

- Accounts receivable | How fast cash comes in

- Inventory is the hidden drain on working capital

- How P2P automation supports working capital management

- Knowing what you can pay and when

- Supplier statement reconciliation and working capital protection

- Protecting working capital from risk and leakage

- Controlling spend without slowing business

- What changes once automation is implemented

- Automation that overcomes real-world complexity

- How to execute working capital optimization

- Working capital optimization through better document intelligence

- Working capital optimization FAQs

- Free eBook: Calculating the Cost of Doing Nothing | Your AP Automation Wake-Up Call

What is working capital?

Working capital represents the liquidity a business needs to operate day-to-day – cash, accounts receivable, accounts payable, and inventory. Working capital optimization focuses on improving how efficiently these elements work together.

It’s about balance. Enough cash on hand to meet obligations.

- No excess tied up in slow-paying customers, early supplier payments, or surplus stock

- No leakage from errors, overpayments, or fraud

Unfortunately, achieving that balance is harder than it sounds. Finance teams must coordinate procurement, treasury, AP, AR, and inventory management. They must time inflows and outflows precisely while keeping operations running smoothly. Small delays or mistakes repeat across thousands of transactions.

If working capital is poorly managed, the consequences land quickly.

- Suppliers are paid late

- Discounts are missed

- Borrowing increases

- Teams scramble to understand their cash position

When too much capital is locked up, returns suffer. When too little is available, operations are at risk.

Working capital optimization is not about aggressively squeezing every supplier or chasing every customer. It’s about building processes that support consistency, visibility, and control.

How working capital is measured

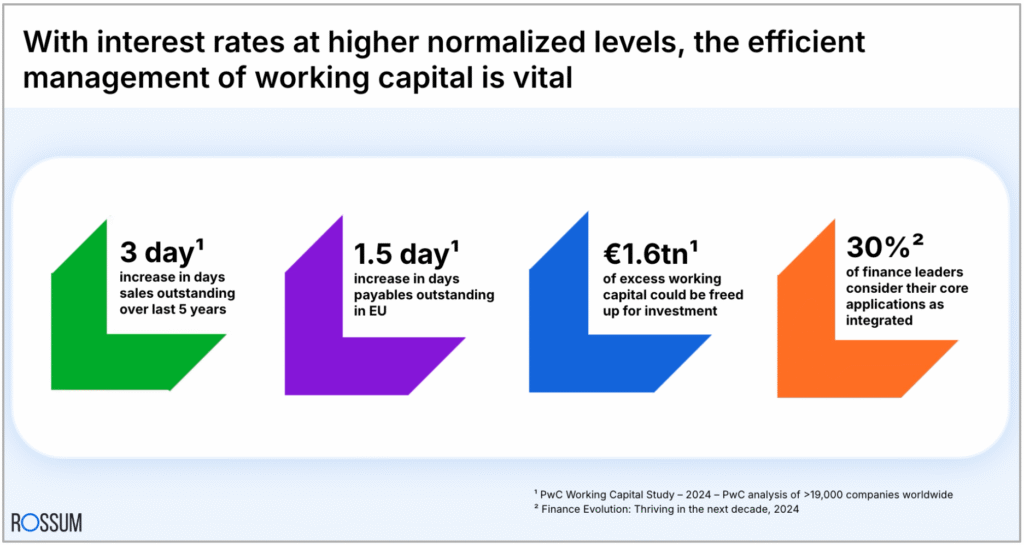

Finance leaders track working capital through a small set of metrics that reveal how cash moves through the business.

- Days sales outstanding – DSO – measures how long it takes to collect payment after a sale. Lower DSO means faster inflows.

- Days payable outstanding – DPO – tracks how long a business takes to pay suppliers. Higher DPO, within reason, preserves cash.

- Days inventory outstanding – DIO – shows how long inventory is held before it’s sold. Lower DIO reduces carrying costs.

These metrics combine into the cash conversion cycle, calculated as DSO plus DIO minus DPO. The shorter the cycle, the less cash is tied up in daily operations.

High-performing organizations monitor these metrics continuously and use them to guide decisions on payment timing, credit policies, and inventory levels. But even when the metrics are visible, the processes behind them can lag.

- Manual document handling slows approvals

- Errors distort data

- Disconnected systems limit insight

Managing working capital depends not only on measuring outcomes, but also on fixing the processes that produce them.

Current challenges & their impact on working capital. More details in the Boosting Working Capital with Intelligent Document Processing webinar.

Where working capital control breaks down

Despite its importance, many organizations haven’t automated the processes that control working capital. Accounts payable and receivable teams still rely heavily on manual work.

Invoices arrive as paper, scanned images, PDFs, EDI files, or emails. Data must be captured, checked, and entered into ERP systems. Missing information triggers back-and-forth communication. Approvals wait on individuals who are busy or unaware they’re the blocker.

These delays impact both sides of the balance sheet.

- Accounts receivable – delayed orders and invoicing slow cash collection

- Accounts payable – late approvals lead to rushed payments or missed discounts

Finance teams lose sight of what’s owed and when.

Fraud and duplicate payments add another layer of risk. Manual matching struggles to catch subtle anomalies. Errors slip through and are discovered only after cash has left the business.

All of this creates friction that dashboards and KPIs alone can’t fix. Optimization means removing the root causes of delay and leakage.

IDP can catch scenarios manual teams miss, such as a supplier submitting the same invoice twice with slightly different formatting – one a PDF, the other a scanned image, or when invoice amounts are rounded differently but reference the same purchase order.

Optimizing working capital with document automation

Intelligent document processing uses AI, machine learning, and advanced optical character recognition to extract and validate data from business documents. It understands invoices, purchase orders, delivery notes, and statements in all their variations.

Unlike traditional OCR technology, IDP learns from context. It adapts to new layouts, improves with use. And feeds clean, structured data directly into downstream systems such as SAP, Coupa, and NetSuite, without constant rule updates or manual reconfiguration.

In practice, this means faster cycles, fewer errors, and reliable, real-time data that finance teams can trust when making cash decisions.

By digitizing and automating document-centric workflows, IDP helps finance teams spot issues early instead of reacting once cash has already gone.

Accounts payable | Deciding when cash leaves

Accounts payable plays an important role in working capital optimization because it controls the timing and accuracy of cash outflows.

Every delayed invoice approval is a cash decision, whether it’s treated that way or not.

Automated invoice capture and validation

Invoices arrive in many formats, especially in industries like wholesale distribution where suppliers vary widely in size and sophistication. IDP captures invoice data from paper, PDFs, XML, and other formats, then validates it against internal records.

This reduces delays caused by manual entry and correction. Clean data moves through the system faster. Finance teams can plan payment timing with intent instead of rushing decisions at the last minute.

With faster processing, organizations can take advantage of early payment discounts without risking late fees. For example, if a business processes $100M in annual supplier spend and offers 2% early payment discounts, capturing those discounts consistently represents $2M in margin impact without renegotiating a single contract. When invoices arrive late, those decisions vanish. Automation turns payment timing back into a financial force instead of a weakness.

Across thousands of invoices, even a one-day approval delay can shift millions in cash timing over a quarter.

Streamlined approval workflows

Invoices without purchase orders often create bottlenecks. AI document processing routes these invoices automatically to the right approvers based on context and rules. Exceptions are flagged. Approvers receive what they need to make decisions quickly.

Digital workflows replace email chains and manual tracking. Escalations happen automatically when invoice approval workflows stall. Invoices no longer sit ignored in inboxes.

This clear line of sight supports working capital management by ensuring payments are made on time, with fewer surprises.

Preventing overpayments and fraud

IDP strengthens controls by identifying duplicate invoices, mismatches, and anomalies early in the process. AI models compare invoices across suppliers, amounts, dates, and references to surface risks that manual checks miss.

By stopping inaccurate payments before they’re released, organizations protect working capital and avoid the cost and effort of recovery.

Accounts receivable | How fast cash comes in

Accounts receivable affects how quickly cash enters the business. Delays here extend the cash conversion cycle and increase reliance on credit.

Back in 2023, a survey issued by Versapay and Wakefield Research showed that 77% of accounts receivable teams were behind on collections. Almost 37% were weeks/months behind. While 2.33% reported that they’d “never fully catch up.”

When IDP automatically extracts and matches customer payment data against open invoices, AR teams can identify partial payments or deductions immediately rather than finding them weeks later during month-end reconciliation, reducing disputes and accelerating resolution.

Faster order and invoice processing

AI document processing accelerates sales order processing by extracting data from incoming documents and feeding it directly into order management systems. This reduces delays between order receipt, fulfillment, and invoicing.

Faster invoicing leads to faster payment. Even small delays get worse at scale. If invoicing slips by three days across thousands of orders, expected cash moves out of the month or quarter entirely. Forecasts drift, credit usage increases, and finance teams spend time explaining variance instead of managing it.

Predictive collections and cash forecasting

AI models trained on payment history can predict which customers are likely to pay late. AR teams can focus their efforts where they matter most, adjusting collection strategies based on risk.

This improves DSO and supports more accurate cash forecasting. Finance leaders gain clearer insight into future inflows, which informs decisions on spending, borrowing, and investment.

Inventory ties up cash, often more than any other working capital component. For a mid-sized distributor carrying $25M in inventory, even a 10% reduction in excess stock frees $2.5M in working capital. Equivalent to improving DSO by nine days on $100M in annual revenue. While intelligent document processing doesn’t manage inventory directly, it improves the data that inventory decisions depend on.

Accurate information captured from shipping notices, receipts, and related documents ensures inventory systems reflect reality. This enables better demand forecasting and stock planning.

For wholesale distributors managing large volumes across multiple locations, accurate document data captured via wholesale distribution software helps avoid excess stock and shortages.

How P2P automation supports working capital management

The procure-to-pay cycle connects purchasing decisions to cash outflows. Automation across this cycle reduces snags and strengthens control.

Invoice data capture at scale

A large part of business invoices remain paper-based or unstructured. Document automation handles this complexity by standardizing data across formats.

By reducing manual effort, organizations lower processing costs and free AP teams to focus on higher-value, strategic work. Faster processing shortens approval cycles and improves payment timing.

Real-time visibility and reporting

Automated workflows provide real-time insight into invoice status, liabilities, and upcoming payments. Finance teams no longer need to rely on estimates or outdated reports.

This transparency supports better liquidity planning and reduces the risk of cash shortfalls.

No CFO ever complained about seeing their cash position more clearly.

Knowing what you can pay and when

To optimize your working capital, you need to know where cash sits and how it’ll move.

- Current cash positions by account and region

- Approved but unpaid liabilities

- Expected inflows based on real payment behavior

Payment hubs and treasury platforms consolidate information across bank accounts and payment methods. When integrated with automated AP processes, they give you a clear view of cash positions and forecasts.

Automated allocation of incoming and outgoing payments reduces manual effort and errors. Dashboards identify trends and support decision-making.

For organizations operating across regions, centralized payment control reduces risk and improves efficiency.

Supplier statement reconciliation and working capital protection

Supplier statements often reveal discrepancies that affect working capital. Overpayments, missed credits, and unclaimed discounts reduce available cash.

Automated statement reconciliation compares supplier statements against internal records continuously. AI-based matching identifies issues quickly, even when references differ.

By reconciling more statements more often, businesses increase the chance of catching errors. Recovering these amounts improves working capital without changing commercial terms, often months later.

Protecting working capital from risk and leakage

Risk directly impacts working capital. Fraud, compliance failures, and supplier disruptions all lead to unexpected cash outflows.

AI-powered analytics help find unusual transactions before payments are approved. Patterns such as abnormal amounts, timing, or supplier behavior are flagged for review.

Ongoing supplier tracking adds another layer of protection. Screening for sanctions, adverse media, and financial health reduces the risk of disruption. Early warnings give teams time to respond without impacting operations or cash flow.

Automated audit capabilities also protect working capital by uncovering historical errors and supporting recovery efforts.

Controlling spend without slowing business

Spend discipline supports working capital by ensuring cash is used according to plan.

With clean, structured data from IDP, organizations gain clearer insight into where money is going. Analytics reveal trends, supplier performance, and contract compliance.

This information supports better negotiations, improved terms, and informed decisions on which suppliers to prioritize for timely payment. Strong supplier relationships often lead to more flexible terms, which support DPO objectives.

What changes once automation is implemented

Automation delivers immediate operational gains…

- Lower processing costs

- Faster cycles

- Fewer errors

These gains reduce cash leakage and support working capital management.

The strategic benefits follow…

- Faster approvals enable early payment programs that reinforce supply chains

- Accurate data supports better forecasting and planning

- Finance teams spend less time fixing issues and more time managing cash

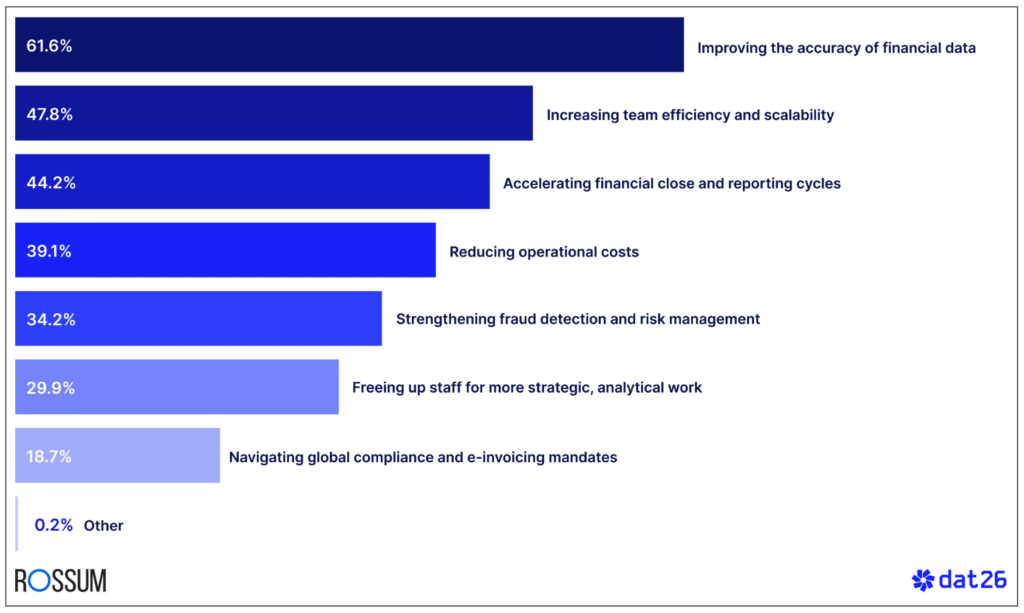

Our 2025 automation statistics survey of finance leaders showed that 61.6% prioritized improving accuracy of financial data. Not efficiency. Not cost savings. Accuracy. It’s not an option. It protects reporting integrity, reduces audit exposure, and prevents compliance failures at scale.

For wholesale distributors, where volume and complexity are high, these benefits scale quickly. For other industries, the same principles apply.

Automation that overcomes real-world complexity

Enterprise environments are complex. Multiple ERPs, varied suppliers, and high transaction volumes demand flexible automation.

IDP platforms like Rossum are designed to adapt to this complexity by…

- Handling changing document formats without constant reconfiguration

- Integrating with existing systems rather than replacing them

- Learning from user feedback over time

This adaptability makes IDP a practical foundation for optimizing working capital. It supports gradual improvement without forcing disruptive change.

How to execute working capital optimization

Improving working capital starts with automating document-heavy processes that control cash flow.

Start by digitizing invoice capture and approvals. Extend automation to reconciliation and risk checks. Use the resulting data to improve forecasting and spend control.

Each step removes friction from daily cash operations. Together, they reduce delays, uncertainty, and unpleasant surprises.

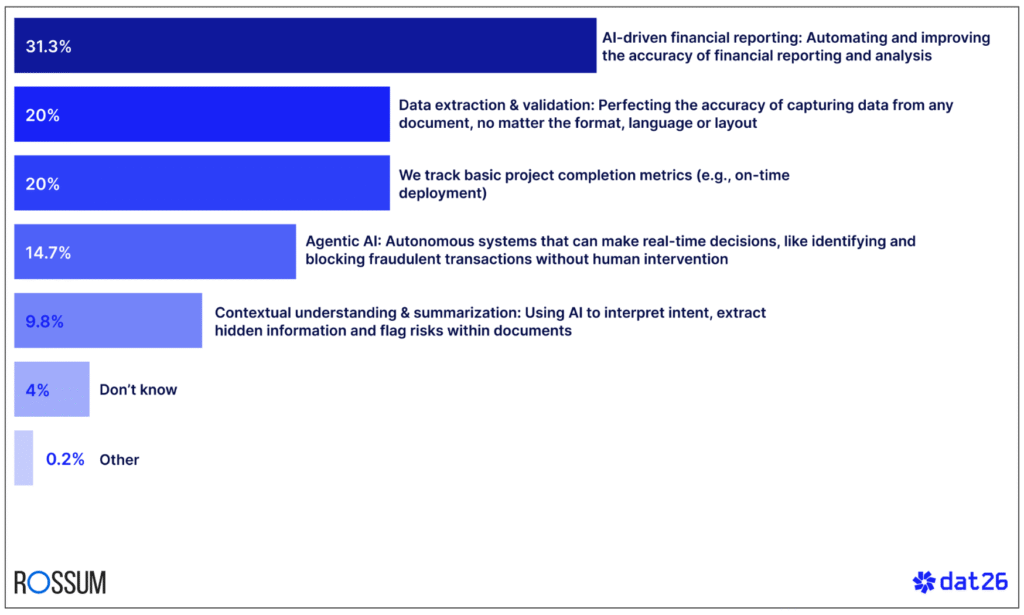

What differentiates finance teams is their ability to spot anomalies early, forecast variances with confidence, and address issues before they affect financial reporting. Which is why 31.3% of finance leaders identified AI-driven financial reporting as the capability with the biggest impact on operations.

Working capital optimization through better document intelligence

Working capital can deliver immediate, measurable impact. But many businesses try to manage it through reports and targets while leaving the underlying processes untouched.

That approach only goes so far.

When invoices take weeks to process, approvals stall, or errors slip through unchecked, working capital suffers no matter how closely metrics are monitored. Cash gets trapped in delays. Risk increases. Finance teams stay reactive.

Working capital optimization doesn’t fail because finance teams lack insight or discipline. It fails when the processes that move cash introduce delay, error, and uncertainty at scale.

Intelligent document processing fixes this at the source. By accelerating how invoices, orders, and statements are captured and validated, it shortens cash cycles, improves accuracy, and restores confidence in daily cash decisions. For enterprises managing complexity at scale, working capital optimization starts with fixing how work moves.

Working capital optimization FAQs

Working capital optimization focuses on improving how efficiently cash, receivables, payables, and inventory move through a business. The aim is to keep enough liquidity for operations while avoiding excess cash tied up in slow processes, errors, or surplus stock – especially in AP, AR, and inventory workflows.

Enterprises process high transaction volumes across fragmented systems and regions, which increases the risk of delays and cash leakage. Optimizing working capital improves liquidity, reduces borrowing needs, and gives finance leaders better control over timing and risk.

Invoice processing automation reduces errors at the point of entry and improves visibility into payables and receivables. This allows finance teams to manage payment timing, improve forecast accuracy, and protect cash from overpayments and fraud.

Accounts payable controls when cash leaves your business. Having an efficient AP processes helps you pay suppliers on time, capture early payment discounts when appropriate, and avoid rushed or duplicate payments that harm working capital.

Intelligent document processing accelerates document-heavy workflows across AP and AR by extracting and validating data automatically at the point documents enter the process. Faster processing improves DSO, supports better DPO management, and shortens the cash conversion cycle by removing delay at the source.

Free eBook: Calculating the Cost of Doing Nothing | Your AP Automation Wake-Up Call

Now it’s time to take the leap. Our free eBook – Calculating the Cost of Doing Nothing | Your AP Automation Wake-Up Call – reveals the scary impact of doing nothing. Of persevering with manual document processing in your finance team.

It highlights the benefits of accounting automation, questions to ask an IDP vendor in your RFP, and the long-term damage of doing nothing. Our goal is to help you devise an action plan for your business’ AP automation strategy.