What is e-invoicing? How it works and how businesses can be compliant with regulations

What is e-invoicing?

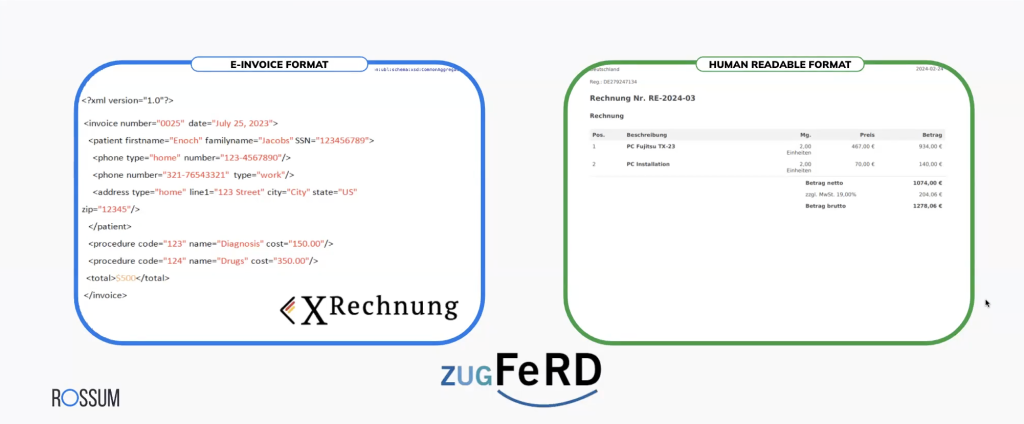

An electronic invoice, or e-invoice, is a type of digital invoice. By definition, an e-invoice is a digital document created, sent, and received in a standardized format that enables automated electronic processing. The standardization of data and formats ensures that accounting software can read and process these e-invoices efficiently. While human-readable documents are still important, they have become less of a priority in the e-invoicing ecosystem.

A three-step framework offers a simple, yet holistic approach for enterprises assessing how to approach compliance with the e-invoicing regulations:

- Prepare your people: Continuous training of your teams and awareness programs ensure a smoother day-to-day operation, and long-term compliance. Mapping your key stakeholders (customers & suppliers) to ensure they’re aware and prepared.

- Prepare your technology: Invest in e-invoice compliant tech that meets the German e-invoicing format standards. Analyze other systems and processes (e.g., purchasing and sales (prices), financial accounting, invoicing, invoice dispatches, etc.). Such an analysis should be conducted with a view to centralization and standardization and achieving greater efficiencies and potential cost minimization, particularly if the extended reporting obligations under the ‘VAT in the Digital Age (ViDA)’ initiative are taken into account.

- Prepare your processes: Redefine your document processing workflows to align with new regulations across markets. Ensure your ERP system is prepared to receive said invoices.

Why e-invoicing regulations were put in place

E-invoicing regulations were not only put in place to modernize and streamline B2B transactions, but also to enhance tax compliance and reduce fraud in business operations.

According to the EU Commission’s 2022 VAT Gap report, which stands for the difference between the expected tax liability number and the actual VAT revenue generated, it is estimated that there are around 93 billion euros lost due to:

- VAT fraud and evasion

- VAT avoidance and optimization practices

- Bankruptcies and financial insolvencies

- Miscalculations and administrative errors (which can easily be avoided if you ask us!)

The “VAT in the Digital Age (ViDA) proposal intends to make businesses more resilient to fraud. The ViDA proposal addresses three key points: Digital Reporting Requirements (DRRs), the Platform Economy, and The Single Place of VAT Registration.

In a perfect world, yes it’s possible to eliminate revenue losses. However, the reality is that modern regulations and policy measures are only one of the tools used to reduce the VAT Gap. They also need to be complemented with the compliant technology.

E-invoicing regulations are not the same everywhere. In some places they’re placed and enforced for specific types of businesses or transactions. In others they’re optional, but they’re encouraged to adopt through incentives.

Embracing e-invoicing as the new standard has multiple advantages for both companies and public sectors.

What are the benefits of implementing e-invoicing in B2B transactions?

Implementing e-invoicing in B2B transactions offers significant advantages for both governments and businesses alike. While some argue that small and medium enterprises (SMEs) may face challenges during the transition due to limited technical and financial resources compared to larger corporations, the long-term benefits extend far beyond reducing the VAT gap. E-invoicing streamlines processes, enhances accuracy, and provides a substantial return on investment for businesses of all sizes, ultimately fostering a more efficient and transparent economic ecosystem.

Some of the benefits of implementing e-invoicing in B2B transactions include:

- Efficiency, which leads to increased business competitiveness and improved revenue margins

- Less manual data entry work, therefore reducing human-induced error rates

- Cost savings

- Accelerating the speed of payments

Transparency, traceability, and easier auditing (automated compliance reporting: VAT returns and customs declarations)

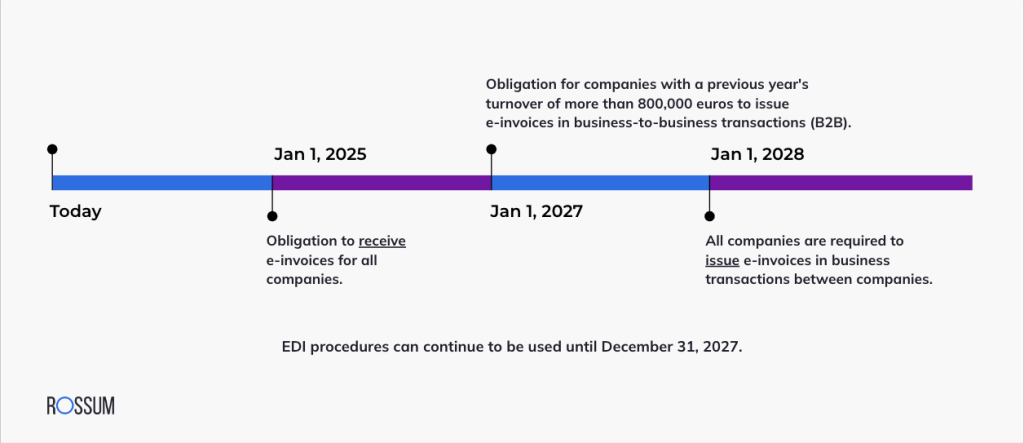

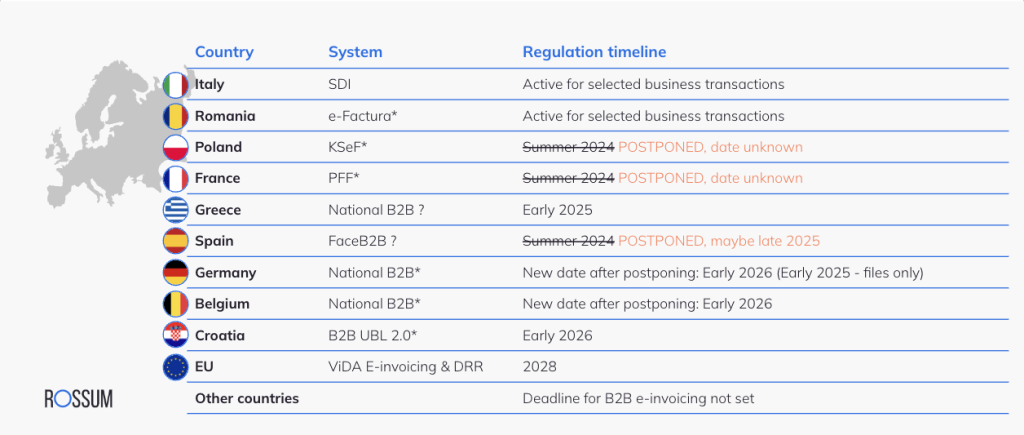

E-invoicing implementation timeline per EU country

E-invoicing regulations are being adopted globally, but implementation timelines vary widely across jurisdictions. This variation stems from a multitude of factors, including technological readiness, industry resistance, governmental priorities, and economic considerations. While some nations have swiftly embraced e-invoicing, others face challenges that slow their progress. Please note that the below diagram might not be accurate as regulation timelines are constantly changing.

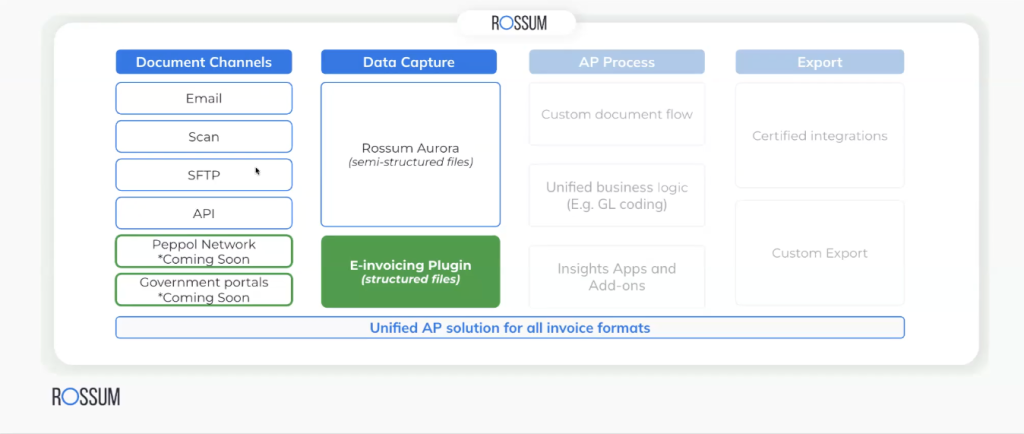

How does Rossum’s e-invoicing plugin work?

Rossum’s e-invoicing plugin is a one-click solution that customers can enable from the Rossum Store, so their environment can start receiving and processing the standardized EN 16931 formats.

Nothing changes in the queues or the UI, everything stays the same – ingestion, data extraction, data matching, automated approval workflows, etc. Except that you are now able to seamlessly receive and process e-invoices.

Receiving the invoices will remain the same for users, whether that’s via a centralized Rossum email, API, EDI, etc. Additionally, Rossum will soon become an official PEPPOL endpoint, making it even easier for users to be compliant.

To ensure even more flexibility, customers can choose which e-invoicing plugin they want to enable depending on their business needs. If your business deals with Germany-based companies? You only need to enable that. Your business expands to reach the French market? You can enable the France plugin too. You get the idea.

Given the regulatory timelines, only the Rossum e-invoicing Germany plugin is available in the store, with plans to roll out a plugin for each country in the near future. Stay tuned for further updates.

The plugin not only enables you to receive and process the new formats of documents, but also allows you to convert it to a human-readable format. Sure, you can try to read the XML code file yourself, but think of the time and effort required to observe and data match.

Do I still need to invest in an intelligent document processing solution like Rossum?

Short answer: Yes.

Just because you’re receiving and processing e-invoices, does not mean you no longer need a robust intelligent document processing solution in place. Let me explain.

While the ability to receive and process e-invoices represents a significant advancement for Accounts Payable teams, it does not negate the need for intelligent document processing solutions like Rossum. E-invoices merely provide a standardized digital format that computers can read more efficiently. However, this standardization alone does not address several critical aspects of invoice processing:

- Fraud Detection: E-invoices do not inherently prevent fraudulent documents. Intelligent processing systems can apply advanced algorithms to detect anomalies and potential fraud that might slip through standardized formats.

- Error and Exception Handling: During the initial implementation phase of e-invoicing, errors are common as vendors adapt to new systems. Intelligent document processing can identify and flag these errors, ensuring accuracy in financial records.

- Format Variability: E-invoice formats can vary significantly between countries and even industries. An intelligent system can adapt to these variations without requiring constant manual intervention.

- End-to-End Automation: Solutions like Rossum offer comprehensive workflow automation beyond mere document ingestion. This includes:

- Scalability: As businesses grow and transaction volumes increase, intelligent processing solutions can scale to handle higher volumes without a proportional increase in resources.

- Insight Extraction: Intelligent document processing solutions can uncover valuable insights that might go unnoticed, like early-payment benefits, cashflow optimization, compliance monitoring and more.

- Continuous Improvement: Machine learning-based systems like Rossum can learn from each processed document, continuously improving accuracy and efficiency over time.

- Legacy Document Handling: Many organizations will continue to receive a mix of e-invoices and traditional formats. An intelligent system can process both seamlessly.

While e-invoices streamline certain aspects of accounts payable, they are just one part of a complex process. Intelligent document processing solutions provide the comprehensive tools needed to truly optimize and automate the entire accounts payable workflow, offering benefits that extend far beyond the capabilities of e-invoices alone.

The new e-invoicing regulations require EU businesses to adapt to receiving and processing structured documents in a new format through different channels. This transition doesn’t have to be complex or disruptive to your current operations. With the right partner guiding you, implementing e-invoicing can be straightforward and seamless. By embracing this change proactively, you can ensure compliance while potentially streamlining your invoice processing, rather than creating additional work for your team.