Beyond the Paper Trail: Meet Rossum’s E-Invoicing Solution for Accounts Payable

The promise of e-invoicing is simple: a world of seamless document exchange and automated efficiency. But for global businesses, that’s not the reality. As more countries in Europe mandate e-invoicing in the coming year, this regulatory shift is reshaping how your accounts payable (AP) team must operate.

At Rossum, we understand the challenge of future-proofing your business against the growing complexity of e-invoicing regulations. That’s why we’re excited to introduce a major expansion of our platform with our new e-invoicing solution, which is designed to bring e-invoices alongside your legacy PDFs into one intelligent, automated workflow.

Ready or not, the e-invoicing revolution is here

The global push for digital transformation has made e-invoicing a standard practice, with major efforts already in place across regions like LATAM and APAC. In Europe, e-invoicing has been introduced primarily to fight VAT fraud, improve compliance, streamline cross-border trade, and increase business efficiency.

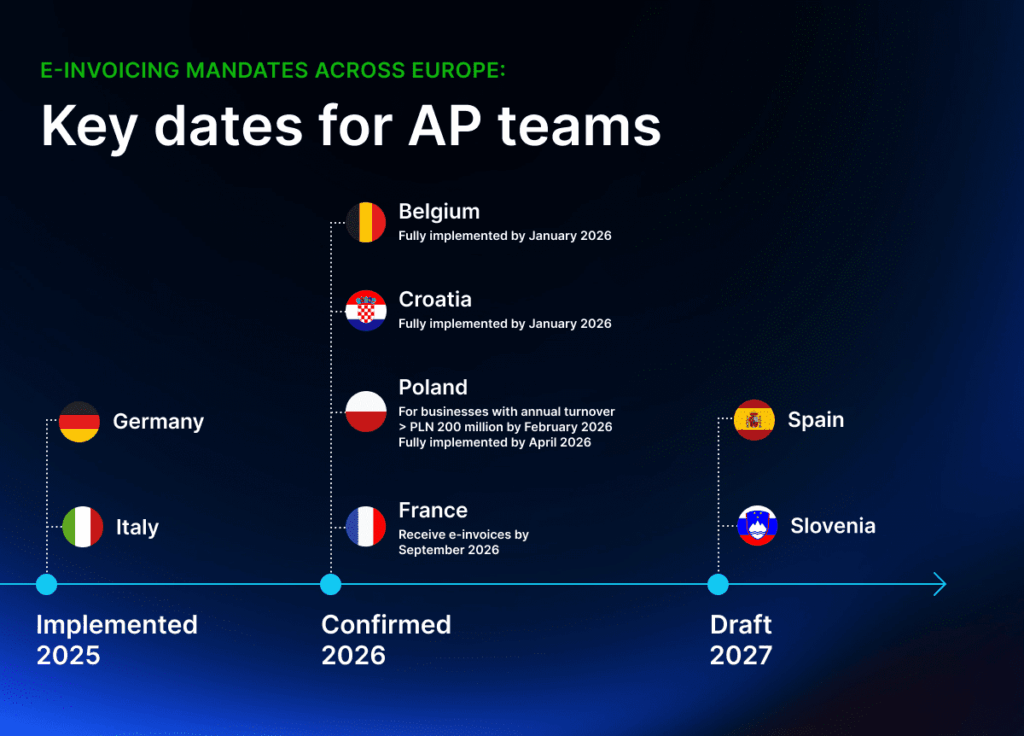

The rollout has already started in some countries, such as Italy and Germany. As e-invoicing adoption accelerates across Europe, 2026 is shaping up to be a critical tipping point, with countries like France, Poland, and Belgium launching their own standards.

While enterprises could previously have gotten away with a simple e-invoice system or a small patchwork of solutions for specific countries, juggling individual approaches for each new standard is a recipe for lost efficiency and impacted productivity.

receiving e-invoices that AP teams must navigate.

Note: Dates, currently approved or scheduled, may be subject to change.

Why traditional AP systems fail

While e-invoicing promises a world of automated efficiency, in practice it’s not as simple as just loading a structured file into your ERP. Electronic invoices still need to be fully processed, and that’s where basic e-invoice systems fail to handle the full scope of your accounts payable workflow.

Talking with finance leaders, we’ve identified a number of surprising facts and hidden pitfalls you will need to navigate:

1. Fragmented compliance and evolving regulations

The concept of e-invoicing in Europe is defined by a general, high-level standard, providing a common framework for digital invoices across member states. So what is an e-invoice?

- It is issued, transmitted, and received in a structured machine-readable format (like XML or UBL)

- The format enables the invoice to be processed automatically and electronically

But since there is no clear unified specification, it gives countries the freedom to introduce their own, which they do. That’s why the European e-invoicing landscape is filled with a plethora of formats and transmission methods coming with different timelines. It’s a headache for businesses to keep up.

To help you navigate this, let’s look at the most recent ones:

| Country | File format | Transmission method |

|---|---|---|

| Germany | XRechnung and ZUGFeRD | Peppol |

| Italy | FatturaPA | SdI |

| Belgium | Peppol BIS Billing 3.0 | Peppol |

| Poland | FA(2) | KSeF |

| France | Factur-X | PA (formerly PDP) |

| Spain | FacturaE | FACeB2B |

*This is an overview of the most recent regulations and is not an exhaustive list. It highlights recent, current, and critical upcoming regulations.

You need one comprehensive e-invoicing solution to route all incoming e-invoices into your AP workflows and scale effortlessly as mandates spread.

2. The hybrid format reality

The single biggest misconception about e-invoicing is that traditional PDFs and paper invoices will disappear overnight. Currently, the new e-invoicing standards only apply to invoices issued within a given country – leaving a significant portion of your international and non-mandated documents as legacy formats.

An effective solution must be able to ingest and intelligently process all invoice types, in one place. You shouldn’t have to manage a complicated hybrid workflow with multiple separate systems.

3. The “dirty data” problem

Even when you receive a structured e-invoice, the data isn’t always perfect. Digital invoices contain surprisingly high rates of errors, missing purchase order numbers, and other incorrect fields. Across our sample, we see that up to 50% of e-invoices have some issue.

The government validation checks are built to verify only mandated information for tax purposes, such as the supplier’s VAT number and total amounts. They don’t check for the critical data your company needs for full automation and processing, like GL codes, cost centers, or a valid PO number. And errors like these kill automation, as it requires human intervention to resolve exceptions.

Overcome the “dirty data” issue by employing an intelligent document processing platform with an AI engine that can understand, extract, and match the data from any invoice to deliver on the promise of touchless automation.

Rossum’s unified e-invoicing solution

The challenges of the new e-invoicing landscape demand a platform built to transform your accounts payable workflow for better efficiency. This is where Rossum comes in.

We’ve developed e-invoicing capabilities to not just meet compliance, but to maximize AP automation efficiency. Our unified solution helps you easily maintain business rules and logic across all AP workflows, regardless of file type.

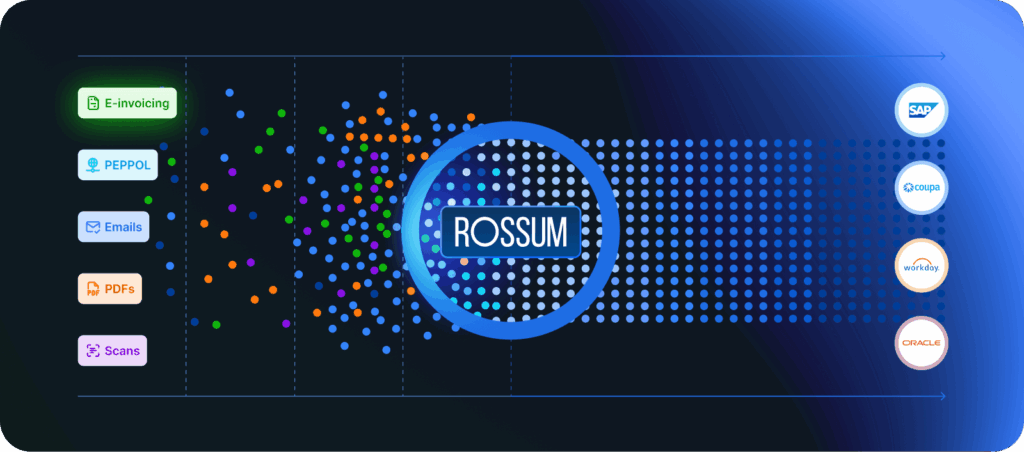

- The one-platform advantage: Our solution provides a unified platform that ingests and intelligently processes all invoice types in the same workflow no matter their format or transmission channel. You can create and maintain consistent business rules and logic throughout with AI that learns and improves over time from your feedback.

- Automation: Our proprietary AI, trained on millions of transactional documents, goes beyond basic validation. It can understand and match data using master data, ERPs, third-party APIs, Gen AI, and business rules. It flags errors and missing data for your review with a generated visual PDF and helps you speed up resolving issues with suppliers. Accelerate exception handling with automated real-time vendor notifications and AI-generated emails.

- Integration: We ensure only the correct data enters your ERP (Coupa, SAP, Workday, NetSuite, and more), leading to high zero-touch automation rates.

Beyond compliance: The e-invoicing benefits

Let’s be honest: government mandates aren’t always welcomed with open arms. But if you zoom out from just meeting the mandated requirements, you can unlock significant business value that can be achieved with the right e-invoicing solution. Just to name a few:

Improved efficiency: By automating invoicing processes, you can significantly reduce errors and accelerate cash flow, leading to faster payment cycles and a more efficient AP team.

High accuracy: Structured data eliminates human error and mismatches that come with manual entry or PDFs. This ensures invoices are validated correctly.

Cost and time savings: Automating invoice processing eliminates expenses related to paper, printing, postage, and archiving. Compared especially to paper invoice processing, our e-invoicing solution provides significant cost savings in human resources and a much faster time-to-process.

Enhanced security: E-invoicing utilizes secure protocols and encryption, verifying sender/receiver identities and protecting against fraud. It minimizes the risk of fake or compromised invoices and reduces the chance of paper or PDF invoices being intercepted.

Future-proof your AP

We believe you should not have to worry about the specific formats and standards. We’re committed to staying ahead of the curve. With every new country approving a mandate, we’ll ensure our platform is ready to support it. Our solution ensures you’re always ready for the next wave of e-invoicing mandates, keeping your global operations running smoothly and allowing you to scale your business expansion or invoice volume without a hitch.

Getting started

You’ve seen how traditional systems fail to handle the hybrid reality of e-invoicing and the risk of dirty data. By choosing a single, intelligent platform like Rossum, you are making an investment in your business’s future. It’s a solution that allows you to scale effortlessly, boost efficiency, and empower your team to focus on strategic work, not on compliance checks.

E-invoicing FAQs

What if I don’t know the ratio of received e-invoices and PDFs?

That’s not a problem. The number of countries and suppliers mandated to send e-invoices will grow over time, and the ratio of e-invoices to legacy formats will keep changing. Thanks to our platform that processes every invoice format the same way in a unified workflow, you don’t have to worry about suppliers switching from legacy formats to electronic invoices. You will still be able to process them seamlessly.

What if we start doing business in a new country or an existing country introduces a new mandate?

The solution is the same no matter the scenario. You can simply add the local entity to your e-invoicing workflows and scale as you grow. No costly new implementation or new provider is needed; Rossum will begin to process the new e-invoices alongside your existing documents, and your team’s workflow remains unchanged.

What if my suppliers don’t adopt e-invoicing on time?

This is a common and valid concern. Even when mandates are in place, supplier adoption can be a long process. Our platform processes every invoice format the same way, whether it’s an e-invoice or a legacy PDF. Your suppliers’ timelines won’t disrupt your workflow, and you will still be able to process all incoming invoices.

How long does it take to get started with Rossum’s e-invoicing solution?

Getting started is fast and simple. Our solution is designed for rapid deployment, and most organizations are up and running in weeks, not months. We’ve built the platform for quick ERP integration so you can begin processing invoices without a lengthy, complicated setup. With predefined rules and a skilled team of experts, you’ll be up to speed in no time and ready to meet the e-invoicing regulations.