Unleashing SAP Integration Potential with Qiado

Today, we sit down with Vincent Sommer to delve into the challenges and opportunities facing finance teams in today’s complex business landscape. With a strong Finance background and a proven track record. Vincent is Head of Business Development at Qiado and has a proven track record in Championing Customer Success in Finance IT Transformation and creating solid powerful partnerships. In this interview, we will explore the pain points finance teams encounter on their automation journey, the impact of poor SAP integrations, and the potential of the Rossum-Qiado partnership to revolutionize financial processes.

Welcome Vincent! Let’s dive in: can you tell us a little bit about Qiado? You have a reputation for transforming AP processes in industries like telecom, healthcare, and manufacturing. What specific challenges have you seen in these sectors when it comes to document processing and their SAP set up?

Indeed, those industries are heavily exposed, and their primary challenges often revolve around the high volume of transactions and the complexity of data management. And therefore, the higher the volumes, the more we are facing inconsistent data entry, manual errors, and delayed processing times, which are common issues but amplified in those verticals. These sectors require robust SAP setups that can handle complex billing cycles, compliance requirements, and intricate supply chains.

Addressing these challenges is prone to more and more integration of smart technologies that automate data entry and provide real-time analytics to improve decision-making and operational efficiency. Having an understanding in both domains, enables us to connect Finance and Business to IT organization in a dynamic way that secure transformation outcomes and successes.

Can you share a real-world example of a client facing significant challenges due to a poorly executed SAP integration? What were the consequences, and how did Qiado help resolve the situation?

In the telecom world, merging external billing systems with SAP often brings up a unique set of challenges. At one of our TelCo customers, we primarily faced two scenarios: one where SAP could handle account receivables directly, and another where we transmit sub-ledger entries to the general ledger within SAP, which is what the option selected in the end.

The real trouble begins when there are mismatches or errors in transmitting data from the Billing Sub-Ledger to the General Ledger, especially during the critical month-end closing process. To tackle these issues effectively, BRF+ integration layer was opted for.

The objective being to seamlessly incorporate all financial transactions from systems outside of SAP. This integration is crucial because it ensures that all additional information required for financial transactions is accurately included through sophisticated mapping and value derivations.

From an integration perspective, our recommendation of using BRF+ as an integration layer has been a game changer for our customer, which we have been advising on architecture options, and running the integration project. We have had the opportunity to present this solution to billing experts across other TelCo in the UK and Spain, and the feedback has been overwhelmingly positive.

Next, how do you see the Rossum and Qiado partnership enhancing your service offerings for SAP clients? What specific benefits do you expect this collaboration to bring to our joint customers?

This partnership between Rossum and Qiado is set to transform how SAP clients manage and process their documents. By integrating Rossum’s AI-driven data capture solutions with Qiado’s expertise in SAP environments, we anticipate a significant reduction in manual data entry errors, faster processing times, and improved compliance tracking, the overall secured by a smooth project experience for our joint customers. This synergy will enable our clients to harness the full potential of automation, leading to enhanced operational efficiencies and better data governance.

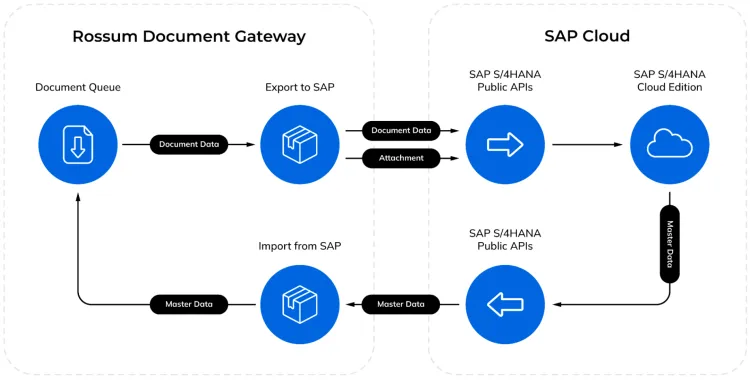

How the Rossum + SAP integration works (Automation Suite 1.0 for SAP S/4HANA Cloud)

I always like to end my interviews with some advice for our audience. As we look ahead to 2025, what key areas should finance leaders focus on to maximize the impact of automation within their SAP environments?

As we approach 2025, finance leaders should prioritize enhancing data transparency, embracing cloud solutions, and fostering a culture of continuous improvement within their SAP environments. Focusing on these areas will allow them to leverage automation not just for cost reduction, but for strategic decision-making and innovation.

Leaders should also invest in upskilling their teams to work alongside advanced technologies and explore partnerships that can extend their capabilities in harnessing the full benefits of automation and AI.